The next Bank of Canada meeting is scheduled for March 12th, 2025. Prevailing economic conditions and expert analyses indicate a strong likelihood of the Bank of Canada implementing a 25 basis point rate cut. Anticipation of rate cuts has already influenced lending rates: several major Canadian banks have reduced their fixed mortgage rates, with CIBC lowering its high-ratio 5-year fixed rate to 3.99%, the lowest among the Big Six banks.

While Lower Mainland real estate markets are experiencing a period of slower growth, conditions remain relatively stable. The increase in new listings and a balanced sales-to-listings ratio suggest that neither a strong seller’s market nor a drastic downturn is imminent.

For buyers, this means there are more options available, and they may have more negotiating power than in previous years. For sellers, pricing homes competitively will be key to attracting interest in a market where buyers have more choices.

As we move further into 2025, much will depend on economic factors such as interest rate decisions, employment stability, and overall consumer confidence. Stay tuned for next month’s update as we continue to track market trends and opportunities.

Real Estate Market Overview - February 2025

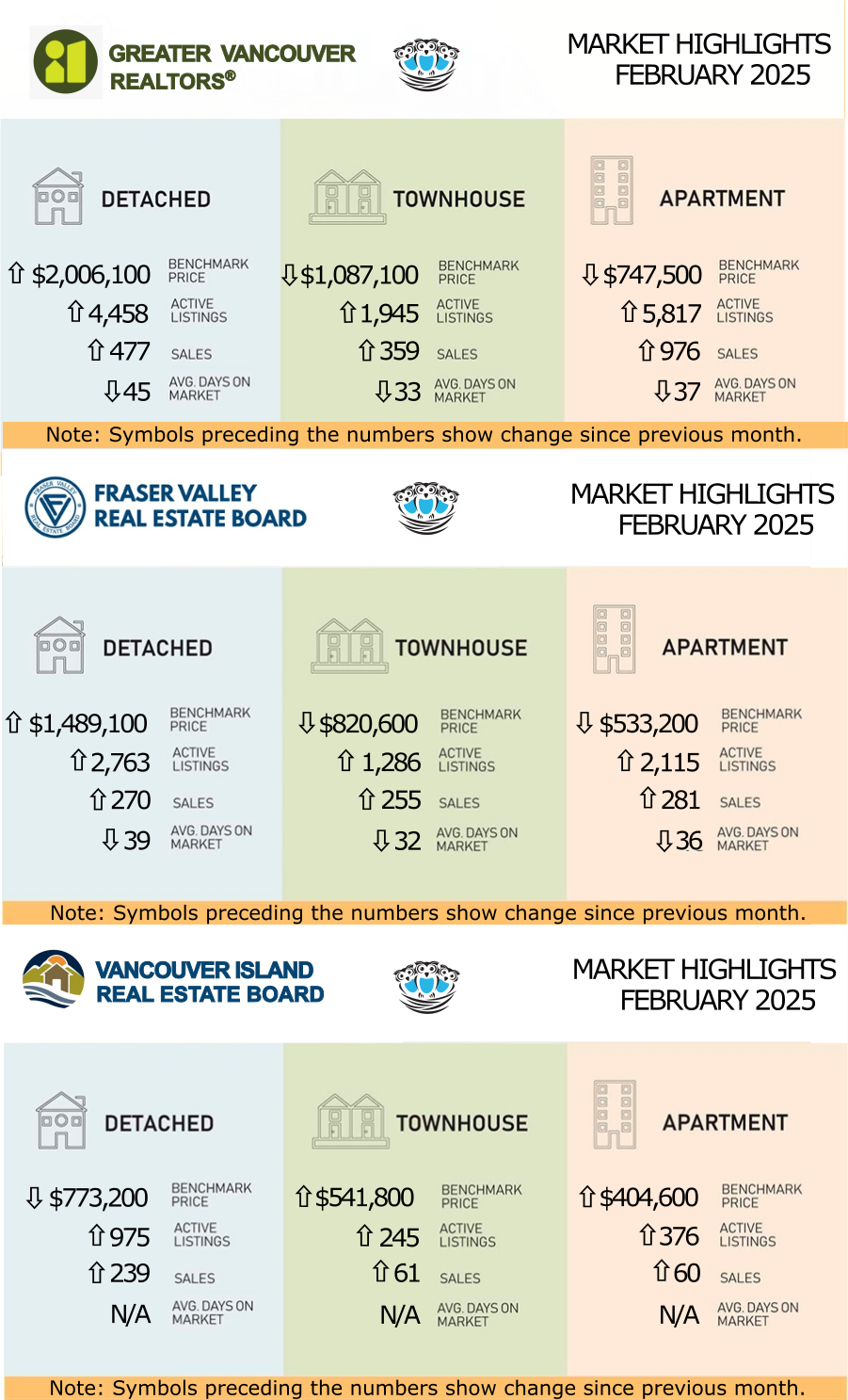

GVR (Greater Vancouver Real Estate Board)

FEBRUARY BRINGS BALANCE TO METRO VANCOUVER'S HOUSING MARKET

“After the rush of new listings in January, home sales and new listings in February were closer to historical averages, which has positioned the overall market in balanced conditions,” Andrew Lis, GVR’s director of economics and data analytics said. “With a potential Bank of Canada rate cut on the table for mid-March, homebuyers may find slightly improved borrowing conditions while enjoying the largest selection of homes on the market since pre-pandemic times.”

LINK to the February 2025 GVR statistics.

FVREB (Fraser Valley Real Estate Board)

BUYERS GAINING UPPER HAND IN FRASER VALLEY REAL ESTATE MARKET

For the first time in four months, home sales in the Fraser Valley have increased as buyers capitalize on more selection and weakening prices.

LINK to the February 2025 FVREB statistics.

VIREB (Vancouver Island Real Estate Board)

UNCERTAINTY SURROUNDING TARIFFS HOLDING BACK BUYERS

“Open houses are busy, phones are ringing, and REALTORS® are showing homes, but some buyers are holding back, which we attribute to the economic uncertainty unleashed by threatened American tariffs that have now become a reality,” says Yochim. “However, forecasts indicate that British Columbia won’t be affected as much as other parts of Canada. Vancouver Island is also somewhat insulated from any unpredictability around mortgage rates due to its large population of retirees, many of whom don’t

require mortgages.”