Happy New Year! We wish everyone a healthy, happy, and prosperous 2025!

We thought that we would start this newsletter by looking back at the year that was 2024.

REAL ESTATE MARKET TRENDS FOR 2024

Market Dynamics & Opportunities:

Market Dynamics & Opportunities:

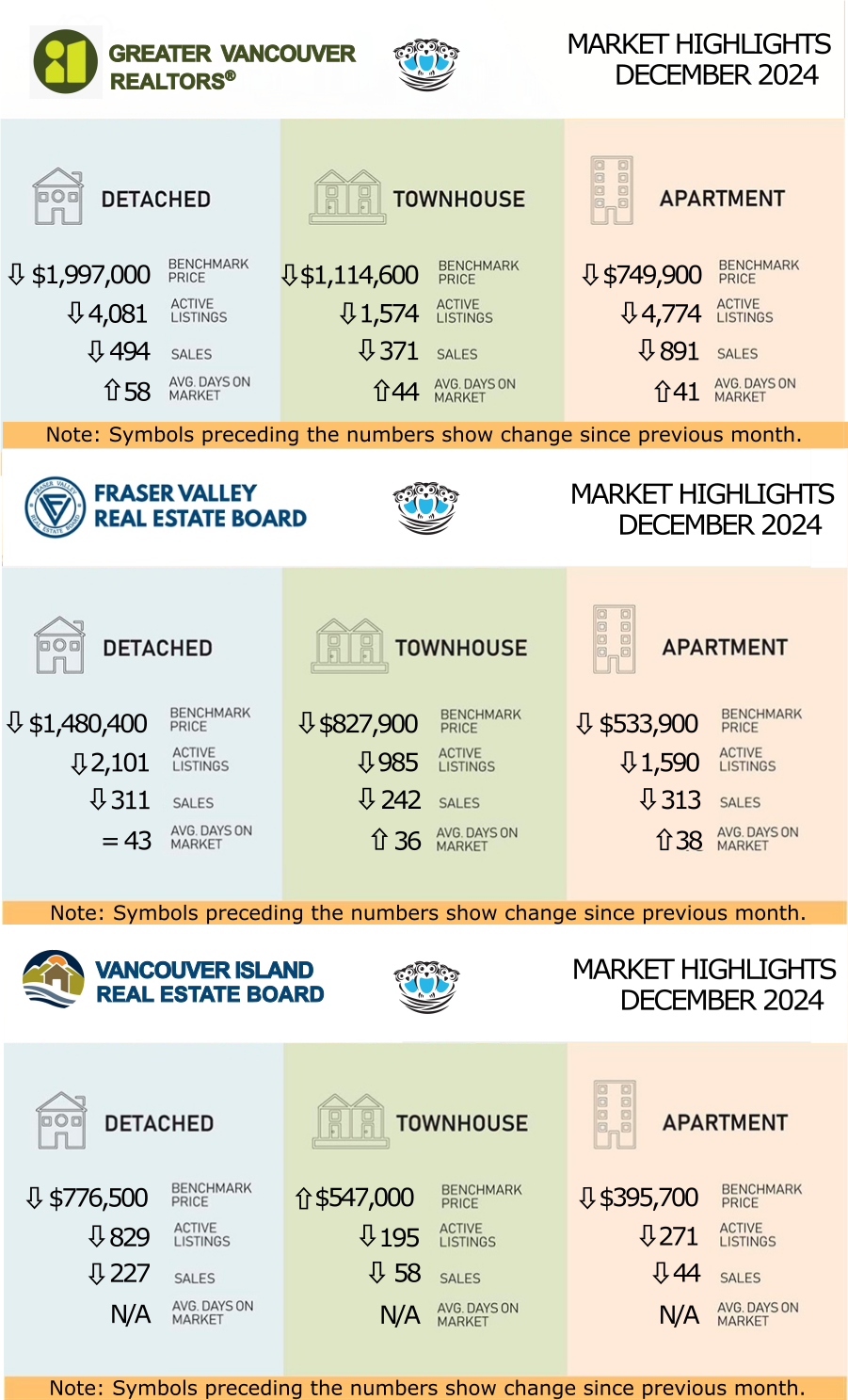

December saw increased sales activity in all of the regional real estate boards, including the GVR, FVREB, and VIREBs, indicating rising buyer confidence.

Industrial commercial real estate remains strong, especially for logistics and warehousing properties. (This may be indicative of a growing economy or could be the result of the large loophole in the Foreign Buyer Ban which allows foreign investment in commercial, and more worryingly, agricultural properties.)

New government incentives for secondary suite construction create revenue opportunities for homeowners. The $40,000 low interest loan available to homeowners that want to add a secondary suite to their property has been increased to $80,000. The terms are 2% over a 15 year period. LINK

Critical Policy Changes:

A new 20% anti-flipping tax on properties sold within 12 months takes effect in January 2024. LINK

Increased scrutiny on money laundering in real estate transactions. Anywhere from $45B to $113B is laundered in Canada every year. LINK to CTV News

Stricter regulations on short-term rentals. See LINK.

New programs introduced in BC to support secondary suite development for the creation of below-market rent housing. LINK

Price Trends & Market Conditions:

Property values have stabilized across most of BC, though affordability challenges persist.

Premium properties, particularly Richmond farmland, continue to command high prices.

Rising inventory levels are easing previous market pressures.

Industrial commercial properties remain strong performers.

BC ASSESSMENT UPDATED

You can look up your home now as the BC Assessment site has been updated with the latest home assessments. LINK

GVR (Formerly REBGV): HOME SALES REGISTER A STRONG FINISH TO CAP OFF 2024

“Looking back on 2024, it could best be described as a pivot year for the market after experiencing such dramatic increases in mortgage rates in the preceding years,” said Andrew Lis, GVR’s director of economics and data analytics. “With borrowing costs now firmly on the decline, buyers have started to show up in numbers after somewhat of a hiatus – and this renewed strength is now clearly visible in the more recent monthly data.”

“Disappointingly, sales came in shy of our forecasted target for the year, but the December figures signal an emerging pattern of strength in home sales, building on the momentum seen in previous months,” Lis said. “These more recent sales figures are now trending back towards long-term historical averages, which suggests there may still be quite a bit of potential upside for sales as we head into 2025, should the recent strength continue.

“Although sales activity had a slower start to the year, price trends began 2024 on the rise and closed out the year on a flatter trajectory. Most market segments saw year-over-year increases of a few percent except for apartment units, which ended 2024 roughly flat. With the data showing renewed strength to finish the year, however, it looks as though the 2025 market is positioned to be considerably more active than we’ve seen in recent years.”

“Disappointingly, sales came in shy of our forecasted target for the year, but the December figures signal an emerging pattern of strength in home sales, building on the momentum seen in previous months,” Lis said. “These more recent sales figures are now trending back towards long-term historical averages, which suggests there may still be quite a bit of potential upside for sales as we head into 2025, should the recent strength continue.

“Although sales activity had a slower start to the year, price trends began 2024 on the rise and closed out the year on a flatter trajectory. Most market segments saw year-over-year increases of a few percent except for apartment units, which ended 2024 roughly flat. With the data showing renewed strength to finish the year, however, it looks as though the 2025 market is positioned to be considerably more active than we’ve seen in recent years.”

LINK to the December 2024 GVR statistics.

FVREB: NEW LISTINGS AT 10-YEAR HIGH IN 2024, BUT AFFORDABILITY STILL THE ELEPHANT IN THE ROOM IN FRASER VALLEY

Bank of Canada interest rate cuts that began mid-year were not enough to ease the affordability crisis for many home buyers in the Fraser Valley in 2024, leading to a decline in annual sales.

“2024 marked another subdued year for Fraser Valley home sales on the heels of a ten-year low in 2023,” said Jeff Chadha, Chair of the Fraser Valley Real Estate Board. “Slight declines in home prices across some areas of the region provided negligible relief for buyers looking to get into the market. At the same time, the modest price adjustments did not discourage sellers from listing.”

“While the Fraser Valley saw overall balanced market conditions for most of 2024, the low levels of buying and selling activity reflected a challenging year for many as would-be buyers waited for affordability to improve,” said Baldev Gill, CEO of the Fraser Valley Real Estate Board. “Interest rate cuts by the Bank of Canada along with recent government policies aimed at boosting overall housing supply and improving affordability, should help to increase market conditions in 2025.”

“2024 marked another subdued year for Fraser Valley home sales on the heels of a ten-year low in 2023,” said Jeff Chadha, Chair of the Fraser Valley Real Estate Board. “Slight declines in home prices across some areas of the region provided negligible relief for buyers looking to get into the market. At the same time, the modest price adjustments did not discourage sellers from listing.”

“While the Fraser Valley saw overall balanced market conditions for most of 2024, the low levels of buying and selling activity reflected a challenging year for many as would-be buyers waited for affordability to improve,” said Baldev Gill, CEO of the Fraser Valley Real Estate Board. “Interest rate cuts by the Bank of Canada along with recent government policies aimed at boosting overall housing supply and improving affordability, should help to increase market conditions in 2025.”

LINK to the December 2024 FVREB statistics.

VIREB: 2024 ENDS WITH A BALANCED MARKET AND A POSITIVE OUTLOOK

VIREB CEO Jason Yochim reports that REALTORS® are feeling optimistic about 2025, with many clients stating they plan to buy or sell this year. “Midway through 2024, VIREB’s housing market was fairly lacklustre, but it picked up steam later in the year,” says Yochim. “Our market remains balanced, indicated by an absorption rate of 15%, which benefits buyers and sellers.”

Looking ahead to 2025, the British Columbia Real Estate Association projects sales in the VIREB area to be around 7,900 this year. However, there is a great deal of uncertainty in the air due to tariff threats made by the incoming American administration. While British Columbia is less dependent on the United States than the rest of Canada (exports of 50% compared to 75%), a 25% tariff would significantly impact the Canadian economy.

VIREB CEO Jason Yochim reports that REALTORS® are feeling optimistic about 2025, with many clients stating they plan to buy or sell this year. “Midway through 2024, VIREB’s housing market was fairly lacklustre, but it picked up steam later in the year,” says Yochim. “Our market remains balanced, indicated by an absorption rate of 15%, which benefits buyers and sellers.”

Looking ahead to 2025, the British Columbia Real Estate Association projects sales in the VIREB area to be around 7,900 this year. However, there is a great deal of uncertainty in the air due to tariff threats made by the incoming American administration. While British Columbia is less dependent on the United States than the rest of Canada (exports of 50% compared to 75%), a 25% tariff would significantly impact the Canadian economy.

LINK to the December 2024 VIREB statistics.