As the holiday season approaches, the market is showing some interesting dynamics. Traditionally, December sees a slower pace as people focus on holiday plans, family gatherings, and festive events. However, this year has been anything but typical!

October’s sales exceeded the 10-year average, and November kept up the momentum. Now, December is starting briskly as many buyers aim to beat the usual January rush. The possibility of a Bank of Canada rate reduction remains uncertain, with inflation trends adding some complexity—current odds seem about 50/50.

October’s sales exceeded the 10-year average, and November kept up the momentum. Now, December is starting briskly as many buyers aim to beat the usual January rush. The possibility of a Bank of Canada rate reduction remains uncertain, with inflation trends adding some complexity—current odds seem about 50/50.

For buyers, this is a fantastic time to keep searching. Fewer buyers mean less competition, and sellers active during December often signal higher motivation. On the flip side, for our sellers, the buyers in the market now are typically serious and may need to act quickly, creating opportunities for both sides.

Whether you’re buying, selling, or simply watching the trends, we’re here to guide you every step of the way. Wishing you a warm and wonderful holiday season!

The Canadian government and the Office of the Superintendent of Financial Institutions (OSFI) have introduced several updates to mortgage regulations for 2024, including:

These measures aim to make homeownership more accessible and adapt to the realities of the current housing market.

- Increased Price Cap for Insured Mortgages

- Extended Amortization Period to 30 Years

- Removal of Second Stress Test for Lender Switching

- New Approach to Regulate Mortgage Risk

These measures aim to make homeownership more accessible and adapt to the realities of the current housing market.

After checking out the statistics below, we have added a new section to our newsletter with some interesting and funny links and videos called "Fun Finds". Be sure to check them out.

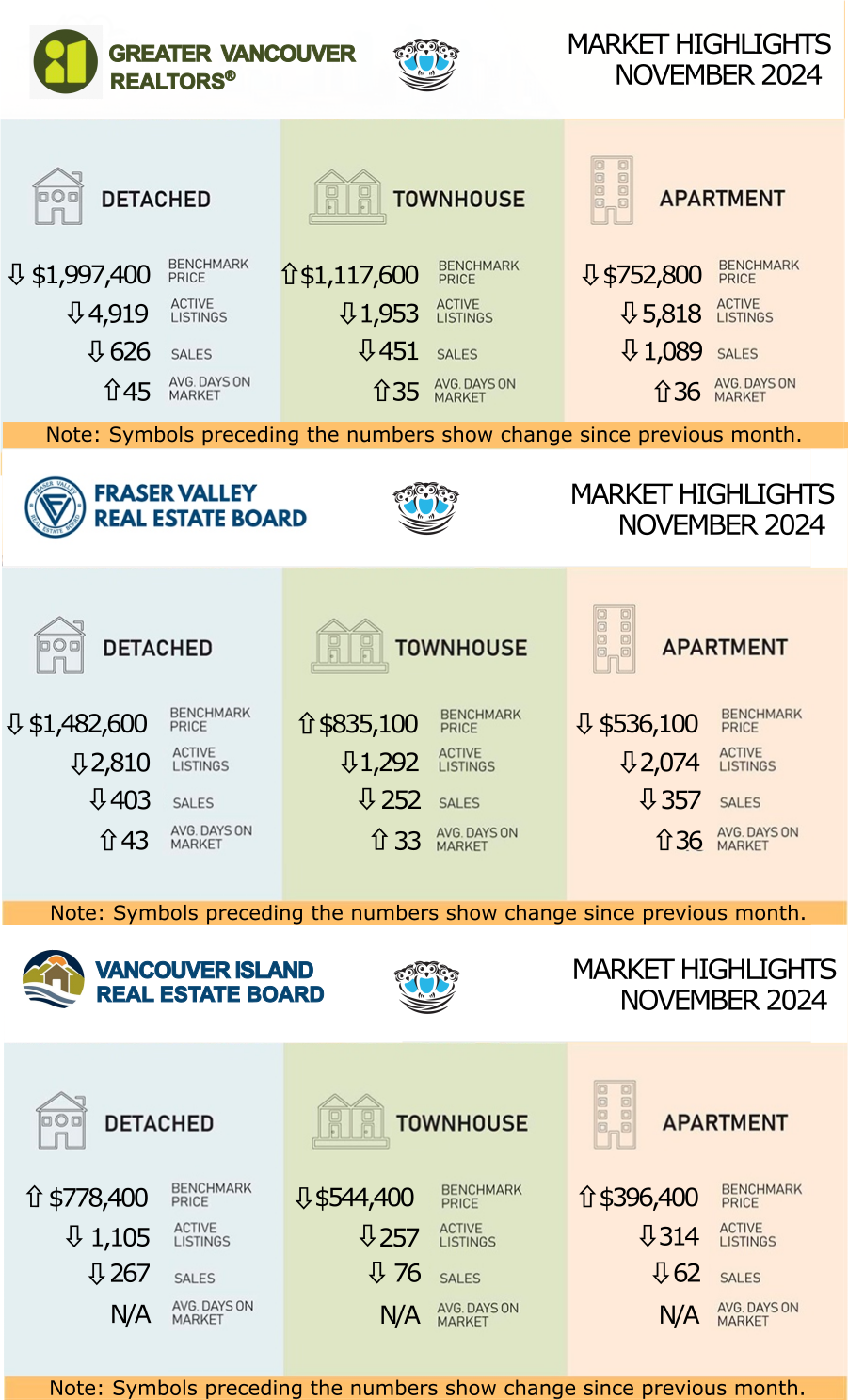

GVR (Formerly REBGV): HOME BUYER DEMAND CONTINUES TO STRENGTHEN IN NOVEMBER

“When we saw demand pick up in October, there was still a question over whether it was a blip in the data or the start of an emerging trend,” Andrew Lis, GVR’s director of economics and data analytics said. “While the November market isn’t quite a Cyber Monday doorcrasher, buyers are continuing to take advantage of the relatively balanced market conditions while they last.”

“Although demand has increased as we head into year-end, the number of newly listed properties coming to market in November remained sufficient to keep prices steady across all segments,” Lis said. “But as we move into the New Year, if the strength in demand continues at the current pace, and the pace of newly listed properties coming to market doesn’t keep up, it may not be long until we see the return of upward pressure on prices.”

“Although demand has increased as we head into year-end, the number of newly listed properties coming to market in November remained sufficient to keep prices steady across all segments,” Lis said. “But as we move into the New Year, if the strength in demand continues at the current pace, and the pace of newly listed properties coming to market doesn’t keep up, it may not be long until we see the return of upward pressure on prices.”

LINK to the November 2024 GVR statistics.

FVREB: FRASER VALLEY HOME SALES RETURNING TO SEASONAL NORMS IN NOVEMBER AFTER OCTOBER SURGE

Following a healthy boost in sales in October, Fraser Valley home sales dropped in November as slower seasonal buying trends set in amid balanced market conditions. “Buying and selling activity is typically quiet at this time of year,” said Jeff Chadha, Chair of the Fraser Valley Real Estate Board. “But it’s worth noting that November 2024 sales are higher than they’ve been compared to the past two Novembers — a sign that overall activity is picking up in the Fraser Valley and with it,

growing buyer confidence.”

“With seasonality expected to slow sales activity towards year-end, we are optimistic that the new mortgage lending guidelines, which come into effect on December 15, will slowly start to work their way into the market,” said Baldev Gill, CEO of the Fraser Valley Real Estate Board. “Longer amortization periods and lower minimum down payments should help more buyers who want to get into the market in 2025.”

growing buyer confidence.”

“With seasonality expected to slow sales activity towards year-end, we are optimistic that the new mortgage lending guidelines, which come into effect on December 15, will slowly start to work their way into the market,” said Baldev Gill, CEO of the Fraser Valley Real Estate Board. “Longer amortization periods and lower minimum down payments should help more buyers who want to get into the market in 2025.”

LINK to the November 2024 FVREB statistics.

VIREB: BALANCED MARKET OFFERS THE BEST OF BOTH WORLDS

VIREB expects to close out 2024 on a good note, with about 7,400 sales, significantly higher than the 7,114 sales seen in 2023. The British Columbia Real Estate Association projects sales in the VIREB area to be around 7,900 in 2025. However, the threat of tariffs imposed by the incoming American administration creates an environment of uncertainty for the Canadian economy as a whole, including the housing market.

VIREB CEO Jason Yochim reports that with an absorption rate of 16 percent, the VIREB area remains in a balanced market, which offers buyers and sellers the best of both worlds.“With just over six months of inventory last month, we edged slightly from a balanced market into one favouring buyers,” says Yochim. “While 2024 transactions haven’t turned out as we’d hoped, members are positive about 2025, with many clients stating they plan to buy or sell next year.’

VIREB expects to close out 2024 on a good note, with about 7,400 sales, significantly higher than the 7,114 sales seen in 2023. The British Columbia Real Estate Association projects sales in the VIREB area to be around 7,900 in 2025. However, the threat of tariffs imposed by the incoming American administration creates an environment of uncertainty for the Canadian economy as a whole, including the housing market.

VIREB CEO Jason Yochim reports that with an absorption rate of 16 percent, the VIREB area remains in a balanced market, which offers buyers and sellers the best of both worlds.“With just over six months of inventory last month, we edged slightly from a balanced market into one favouring buyers,” says Yochim. “While 2024 transactions haven’t turned out as we’d hoped, members are positive about 2025, with many clients stating they plan to buy or sell next year.’

LINK to the November 2024 VIREB statistics.