As we move deeper into the fall, with crisp mornings and shorter days becoming more noticeable, the real estate market remains sluggish, most notably through late summer and early fall. It’s clear that potential buyers without homes to sell first are waiting for anticipated further reductions in mortgage rates. Meanwhile, sellers are facing stiff competition from similar listings, with not enough buyers to meet the increasing supply.

We anticipate that once the market shifts, it could quickly return to our "norm" of multiple offers. The coastal markets seem to experience extremes with little middle ground.

One of the key challenges to address our housing shortage in our rapidly rising population is the need to expedite housing development. The BC Government's density initiative, while promising, will take years to have a measurable impact. Exacerbating the situation is that older, three-story rental buildings are being demolished, leaving empty lots waiting for new towers to be built. These older buildings may have each housed 30 or more rental units, but their removal has reduced the present available rental pool for four to five years. When the towers finally complete, the replacement units are unlikely to rent at the same affordable rates as their predecessors.

To help address the immediate housing shortage, cities and municipalities could consider allowing more secondary suites in existing single-family homes. Additional inspectors would need to be hired to ensure these suites comply with safety standards, including proper occupancy limits, smoke detectors, and safe exits in case of fire. This could provide some relief while longer-term solutions are underway.

Our suggestion to buyers that don't have to sell first is to consider taking advantage of the current buyer's market. Sellers may be more compliant with their pricing and there is less chance of competition from other buyers. Setting longer dates until completion may work for both parties as it will help capture the most potential interest rate reductions.

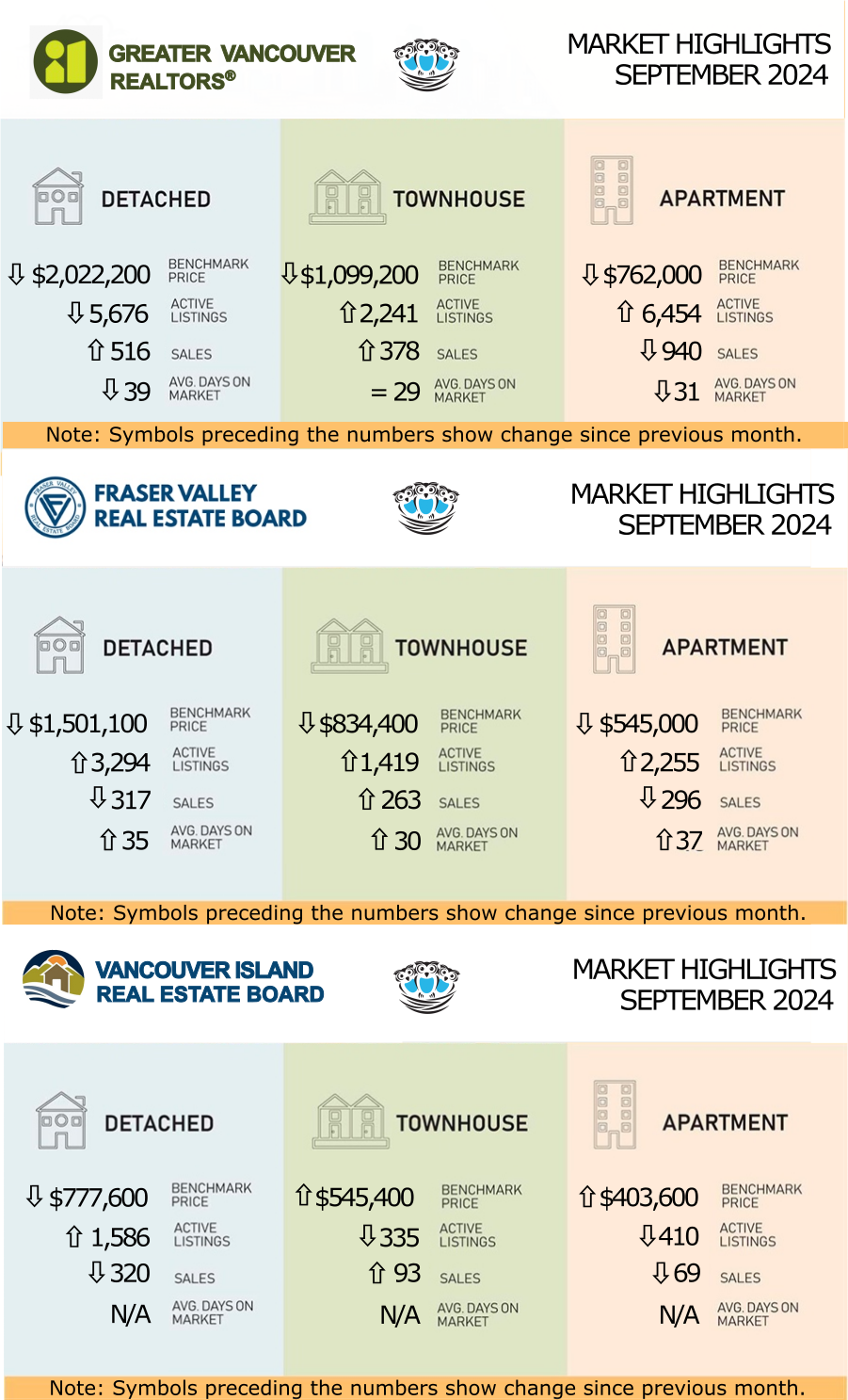

GVR (Formerly REBGV): BUYERS REMAIN CAUTIOUS TO BEGIN THE FALL MARKET

Home sales registered on the MLS® in Metro Vancouver declined 3.8% year over year in September, suggesting recent reductions in borrowing costs are having a limited effect in spurring demand so far.

“Real estate watchers have been monitoring the data for signs of renewed strength in demand in response to recent mortgage rate reductions, but the September figures don’t offer the signal that many are watching for,” Andrew Lis, GVR’s director of economics and data analytics said. “Sales continue trending roughly 25% below the ten-year seasonal average in the region, which, believe it or not, is a trend that has been in place for a few years now. With the September data, sales are now tracking slightly below our forecast however, but we remain optimistic sales will still end 2024 higher than 2023.”

“With some buyers choosing to stay on the sidelines, inventory levels have sustained the healthy gains achieved over the course of this year, providing much more selection to anyone searching for a home,” Lis said. With all this choice available, prices have trended sideways for the past few months. The September figures, however, are now showing modest declines across all segments on a month over month basis. This downward pressure on prices is a result of sales not keeping pace with the number of newly listed properties coming to market, which has now put the overall market on the cusp of a buyers’ market. With two more policy rate decisions to go this year, and all signs pointing to further reductions, it’s not inconceivable that demand may still pick up later this fall should buyers step off the sidelines.”

“Real estate watchers have been monitoring the data for signs of renewed strength in demand in response to recent mortgage rate reductions, but the September figures don’t offer the signal that many are watching for,” Andrew Lis, GVR’s director of economics and data analytics said. “Sales continue trending roughly 25% below the ten-year seasonal average in the region, which, believe it or not, is a trend that has been in place for a few years now. With the September data, sales are now tracking slightly below our forecast however, but we remain optimistic sales will still end 2024 higher than 2023.”

“With some buyers choosing to stay on the sidelines, inventory levels have sustained the healthy gains achieved over the course of this year, providing much more selection to anyone searching for a home,” Lis said. With all this choice available, prices have trended sideways for the past few months. The September figures, however, are now showing modest declines across all segments on a month over month basis. This downward pressure on prices is a result of sales not keeping pace with the number of newly listed properties coming to market, which has now put the overall market on the cusp of a buyers’ market. With two more policy rate decisions to go this year, and all signs pointing to further reductions, it’s not inconceivable that demand may still pick up later this fall should buyers step off the sidelines.”

LINK to the September 2024 GVR statistics.

FVREB: SLUGGISH SALES AND RISING INVENTORIES SEE FRASER VALLEY MOVING TOWARD A BUYER'S MARKET

With active inventories hitting levels not seen in 10 years and sales 30% below the 10-year average, Fraser Valley real estate is building towards a buyer’s market if sales continue to lag.

“With three rate cuts already and more expected before the end of the year, buyers are watching the market closely to time their purchasing decisions,” said Jeff Chadha, Chair of the Fraser Valley Real Estate Board. “The current conditions should favour buyers, particularly in the detached market, however until we start to see some movement in asking prices, properties will continue to sit on the market for extended periods as both buyers and sellers await the next rate announcement.”

The combination of declining sales and rising inventories has helped to create balanced, and in some cases, buyers’, market conditions in the Fraser Valley. “We know the demand is there among Fraser Valley buyers,” said Baldev Gill, CEO of the Fraser Valley Real Estate Board. “After months on the sidelines, buyers want to get into the market but many also need to sell before they can buy. When you factor in affordability challenges and the anticipation of more interest rate cuts, we are seeing persistent weakness in the market. In conditions like these, we encourage buyers and sellers alike to talk to their REALTOR® to assess the risks and opportunities before making a decision.”

“With three rate cuts already and more expected before the end of the year, buyers are watching the market closely to time their purchasing decisions,” said Jeff Chadha, Chair of the Fraser Valley Real Estate Board. “The current conditions should favour buyers, particularly in the detached market, however until we start to see some movement in asking prices, properties will continue to sit on the market for extended periods as both buyers and sellers await the next rate announcement.”

The combination of declining sales and rising inventories has helped to create balanced, and in some cases, buyers’, market conditions in the Fraser Valley. “We know the demand is there among Fraser Valley buyers,” said Baldev Gill, CEO of the Fraser Valley Real Estate Board. “After months on the sidelines, buyers want to get into the market but many also need to sell before they can buy. When you factor in affordability challenges and the anticipation of more interest rate cuts, we are seeing persistent weakness in the market. In conditions like these, we encourage buyers and sellers alike to talk to their REALTOR® to assess the risks and opportunities before making a decision.”

LINK to the September 2024 FVREB statistics.

VIREB: SPRING MARKET ARRIVES IN THE FALL

With active listings at their highest level in five years, slowing inflation, and recent rate cuts, it’s an excellent time to buy. This advice holds particularly true for condo apartments and row/townhouses; the single-family market has been somewhat stagnant lately. “The market we typically see in the spring never transpired, but the increased sales activity in September has the feel of spring,” says VIREB CEO Jason Yochim. “However, there are price reductions occurring throughout our area. Sellers are compromising to attract buyers, and overpriced properties are lingering for several months.”

The British Columbia Real Estate Association reports that inflation is slowing faster than expected, so another interest-rate reduction is likely on the horizon. Further, as reported last month, the Vancouver Island economy is performing remarkably well, with solid job growth, particularly in Victoria. “We feel optimistic about the next few months, but buyers and sellers need to be on the same page,” adds Yochim. “Everyone wants to buy at the bottom of the market, but by the time we realize it’s here, it’s frequently too late.”

With active listings at their highest level in five years, slowing inflation, and recent rate cuts, it’s an excellent time to buy. This advice holds particularly true for condo apartments and row/townhouses; the single-family market has been somewhat stagnant lately. “The market we typically see in the spring never transpired, but the increased sales activity in September has the feel of spring,” says VIREB CEO Jason Yochim. “However, there are price reductions occurring throughout our area. Sellers are compromising to attract buyers, and overpriced properties are lingering for several months.”

The British Columbia Real Estate Association reports that inflation is slowing faster than expected, so another interest-rate reduction is likely on the horizon. Further, as reported last month, the Vancouver Island economy is performing remarkably well, with solid job growth, particularly in Victoria. “We feel optimistic about the next few months, but buyers and sellers need to be on the same page,” adds Yochim. “Everyone wants to buy at the bottom of the market, but by the time we realize it’s here, it’s frequently too late.”

LINK to the September 2024 VIREB statistics.