We hope that everyone had an enjoyable summer and had a chance to celebrate the season with friends and family while the weather was clear.

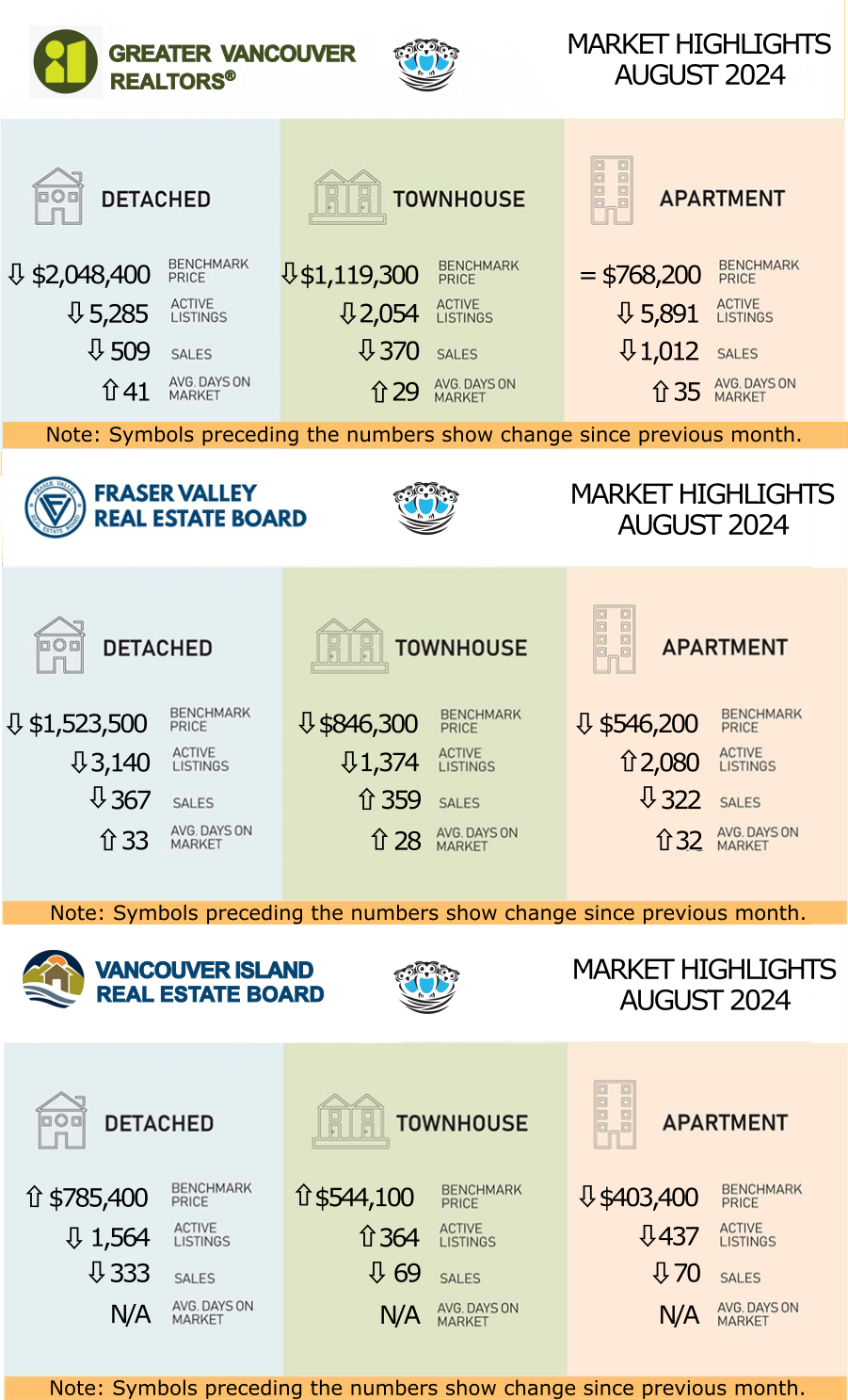

Condo inventories have surged by 40%, and townhouse inventories by 44% since August of 2023 in the GVR, with similar patterns occurring in other regions.

Despite the rise in condo inventories, falling average prices, and consistent decreases in interest rates, the competition for desirable homes is likely to stay strong. This is particularly true for detached homes, as many older homeowners are hesitant to sell properties that feature spacious yards and ample living areas, which are highly appealing to young families. Many of these homeowners may be considering a smaller house and not necessarily a townhouse or a condo.

In desirable school districts, where inventory is still scarce, numerous older homeowners are postponing the sale of their homes, which has led to a significant buildup of demand for larger, family-oriented properties. Properties that are ready to move into, with well-designed layouts, convenient parking, and proximity to schools and transit, are anticipated to continue attracting multiple offers.

This has continued to stall the "property ladder", as those wanting to move into larger homes were unable to sell their current home at the price level that they needed to preserve enough equity to move up the ladder.

We have had three 0.25% interest rate drops since June and there may be more coming at the next Bank of Canada announcements on October 23rd and December 11th. We expect that there will be renewed interest in the market this month as the buyers that are currently on the sidelines start to mobilize. Rents are still high in most areas and the differential between paying a mortgage and paying rent is rapidly reducing.

Condo inventories have surged by 40%, and townhouse inventories by 44% since August of 2023 in the GVR, with similar patterns occurring in other regions.

Despite the rise in condo inventories, falling average prices, and consistent decreases in interest rates, the competition for desirable homes is likely to stay strong. This is particularly true for detached homes, as many older homeowners are hesitant to sell properties that feature spacious yards and ample living areas, which are highly appealing to young families. Many of these homeowners may be considering a smaller house and not necessarily a townhouse or a condo.

In desirable school districts, where inventory is still scarce, numerous older homeowners are postponing the sale of their homes, which has led to a significant buildup of demand for larger, family-oriented properties. Properties that are ready to move into, with well-designed layouts, convenient parking, and proximity to schools and transit, are anticipated to continue attracting multiple offers.

This has continued to stall the "property ladder", as those wanting to move into larger homes were unable to sell their current home at the price level that they needed to preserve enough equity to move up the ladder.

We have had three 0.25% interest rate drops since June and there may be more coming at the next Bank of Canada announcements on October 23rd and December 11th. We expect that there will be renewed interest in the market this month as the buyers that are currently on the sidelines start to mobilize. Rents are still high in most areas and the differential between paying a mortgage and paying rent is rapidly reducing.

GVR (Formerly REBGV): SELLERS AWAIT BUYER'S RETURN AFTER QUIETER SUMMER MARKET

Home sales registered on the MLS® in Metro Vancouver remained below their ten-year seasonal averages in August as summer holidays come to a close.

“From a seasonal perspective, August is typically a slower month for sales than June or July. In this respect, this August has been no different,” Andrew Lis, GVR’s director of economics and data analytics said. “With that said, sales remain in a holding pattern, trending roughly 20% below their 10-year seasonal average, which suggests buyers are still feeling the pinch of higher borrowing costs, despite two recent quarter percentage point reductions to the policy rate this summer.”

“Buyers’ hesitancy to enter the market, paired with new listing activity on the part of sellers that is in line with historical averages, has allowed inventory to accumulate for a number of months and has moved the market firmly into balanced conditions,” Lis said.

“With the Bank of Canada’s decision to reduce the policy rate today by another quarter percentage point, and with September being a month that typically sees an increase in sales from a seasonal perspective, the fall market is set up to bring more buyers off the sidelines. We will watch the upcoming September data to see whether they decide to show up.”

“From a seasonal perspective, August is typically a slower month for sales than June or July. In this respect, this August has been no different,” Andrew Lis, GVR’s director of economics and data analytics said. “With that said, sales remain in a holding pattern, trending roughly 20% below their 10-year seasonal average, which suggests buyers are still feeling the pinch of higher borrowing costs, despite two recent quarter percentage point reductions to the policy rate this summer.”

“Buyers’ hesitancy to enter the market, paired with new listing activity on the part of sellers that is in line with historical averages, has allowed inventory to accumulate for a number of months and has moved the market firmly into balanced conditions,” Lis said.

“With the Bank of Canada’s decision to reduce the policy rate today by another quarter percentage point, and with September being a month that typically sees an increase in sales from a seasonal perspective, the fall market is set up to bring more buyers off the sidelines. We will watch the upcoming September data to see whether they decide to show up.”

LINK to the August 2024 GVR statistics.

FVREB: TWO RATE CUTS NOT ENOUGH TO IGNITE SUMMER HOME SALES IN THE FRASER VALLEY

The Fraser Valley residential resale market slowed again in August, as homebuyers continue to face affordability challenges.

“Despite two policy rate cuts by the Bank of Canada, buyers are still feeling the squeeze of overall affordability challenges in BC,” said Jeff Chadha, Chair of the Fraser Valley Real Estate Board. “With prices for single-family homes, townhouses and condos holding relatively flat year-over-year, many continue to face challenges buying their first home or moving up in the market, as reflected in seasonally slow August sales.”

“Buyers continue to wait on the sidelines in anticipation of more cuts to the Bank of Canada’s policy rate,” said FVREB CEO Baldev Gill. “However, we encourage anyone looking to get into the market to speak with their REALTOR® and lending professional to fully understand where interest rates may be heading in the coming months to determine the optimal long-term strategy.”

“Despite two policy rate cuts by the Bank of Canada, buyers are still feeling the squeeze of overall affordability challenges in BC,” said Jeff Chadha, Chair of the Fraser Valley Real Estate Board. “With prices for single-family homes, townhouses and condos holding relatively flat year-over-year, many continue to face challenges buying their first home or moving up in the market, as reflected in seasonally slow August sales.”

“Buyers continue to wait on the sidelines in anticipation of more cuts to the Bank of Canada’s policy rate,” said FVREB CEO Baldev Gill. “However, we encourage anyone looking to get into the market to speak with their REALTOR® and lending professional to fully understand where interest rates may be heading in the coming months to determine the optimal long-term strategy.”

LINK to the August 2024 FVREB statistics.

VIREB: FAVOURABLE CONDITIONS TRENDING TOWARD BUYERS’ MARKET

VIREB CEO Jason Yochim notes that VIREB’s housing market was flat during spring and summer, but REALTORS® are optimistic about the fall market. “Active listings are at their highest level in nearly five years,” says Yochim. “Combined with recent rate cuts, an anticipated rate cut, and pricing that’s responsive to the current market, it’s an excellent time for buyers to make a move.” “We all want to buy at the bottom of the market,” adds Yochim. “However, by the time we realize it’s here, it’s frequently too late.”

Adding to the favourable picture is a Vancouver Island economy performing remarkably well, with solid job growth, particularly in Victoria, according to the British Columbia Real Estate Association. “Around 30,000 jobs came on line in the Victoria area this year, many of them in IT and the public sector,” says Yochim. “We anticipate that the lower home prices in our area compared to the South Island might appeal to some of those potential home buyers, especially for telecommuters.”

VIREB CEO Jason Yochim notes that VIREB’s housing market was flat during spring and summer, but REALTORS® are optimistic about the fall market. “Active listings are at their highest level in nearly five years,” says Yochim. “Combined with recent rate cuts, an anticipated rate cut, and pricing that’s responsive to the current market, it’s an excellent time for buyers to make a move.” “We all want to buy at the bottom of the market,” adds Yochim. “However, by the time we realize it’s here, it’s frequently too late.”

Adding to the favourable picture is a Vancouver Island economy performing remarkably well, with solid job growth, particularly in Victoria, according to the British Columbia Real Estate Association. “Around 30,000 jobs came on line in the Victoria area this year, many of them in IT and the public sector,” says Yochim. “We anticipate that the lower home prices in our area compared to the South Island might appeal to some of those potential home buyers, especially for telecommuters.”

LINK to the August 2024 VIREB statistics.