Note: The Real Estate Board of Greater Vancouver (REBGV) logo above will be changed in next month's newsletter.

We hope that you've been enjoying the lovely weather over the last few days. The days are getting longer and it's getting harder to get up at the crack of dawn. :^)

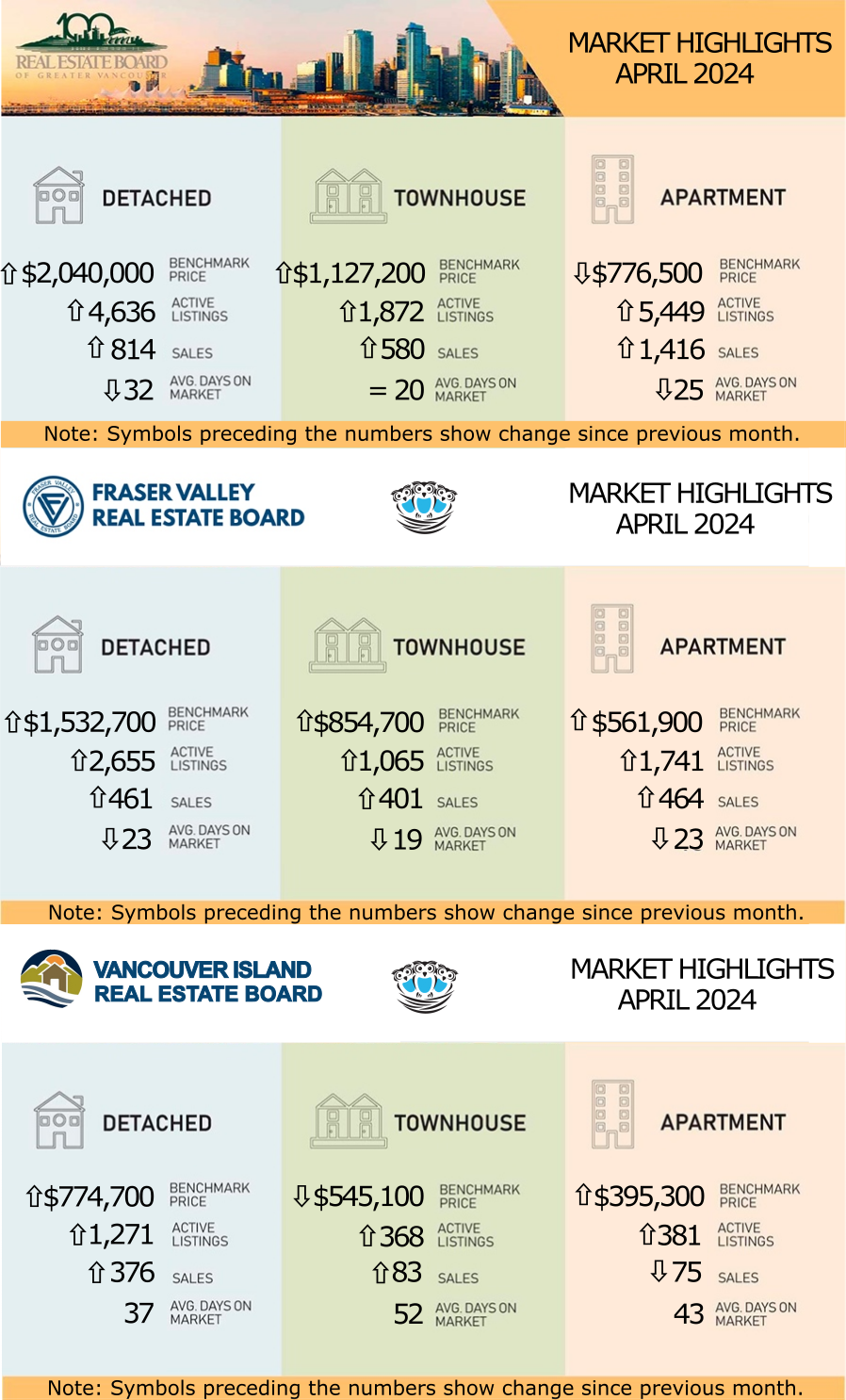

In recent weeks, the real estate market has stirred from its slumber, with inventory swiftly surging, as depicted in the accompanying graph. However, despite this notable uptick in available properties, sales have yet to match pace, as numerous buyers remain on the sidelines for various reasons.

The hurdles facing potential buyers are manifold: elevated interest rates, burgeoning consumer debt, escalating living costs, stricter bank lending regulations, job market uncertainty, and intense buyer competition. All these factors contribute to a cautious approach among prospective buyers.

Looking ahead, all eyes are on the upcoming Bank of Canada meeting scheduled for June 5th. If interest rates remain unchanged at that juncture, it seems increasingly likely that a rate cut will be implemented by July, potentially impacting the dynamics of the real estate landscape.

The hurdles facing potential buyers are manifold: elevated interest rates, burgeoning consumer debt, escalating living costs, stricter bank lending regulations, job market uncertainty, and intense buyer competition. All these factors contribute to a cautious approach among prospective buyers.

Looking ahead, all eyes are on the upcoming Bank of Canada meeting scheduled for June 5th. If interest rates remain unchanged at that juncture, it seems increasingly likely that a rate cut will be implemented by July, potentially impacting the dynamics of the real estate landscape.

In other news...as of May 1st, 2024, the BC government has brought in new legislation to control the short-term rental market: LINK.

If your AirBNB/VRBO suite isn't your primary residence, you can't rent it out anymore except for one secondary suite or accessory dwelling unit (such as a laneway home) on the same property.

The legislation hopes to return a large percentage of homes that were used for short-term rentals into the long-term rental stock, thereby reducing the shortage that has caused rents to skyrocket in the last few years.

GVR (Formerly REBGV): INVENTORY REACHES HIGHEST LEVEL SINCE THE PANDEMIC SUMMER OF 2020

“It’s a feat to see inventory finally climb above 12,000. Many were predicting higher inventory levels would materialize quickly when the Bank of Canada began its aggressive rate hikes, but we’re only seeing a steady climb in inventory in the more recent data,” Andrew Lis, GVR’s director of economics and data analytics said. “The surprise for many market watchers has been the continued strength of demand along with the fact few homeowners have been forced to sell in the face of the highest borrowing costs experienced in over a decade.”

“Another surprising story in the April data is the fact prices continue climbing across most segments with recent increases typically in the range of 1% to 2% month-over-month,” Lis said. “The one segment that didn’t see an uptick in prices in April were apartments, which saw a 0.1% decline month-over-month. This moderation is likely due to a confluence of factors impacting this more affordability-sensitive segment of the market, particularly the impact of higher mortgage rates and the recent boost to inventory levels, tempering competition somewhat.”

LINK to the April 2024 REBGV statistics.

“Another surprising story in the April data is the fact prices continue climbing across most segments with recent increases typically in the range of 1% to 2% month-over-month,” Lis said. “The one segment that didn’t see an uptick in prices in April were apartments, which saw a 0.1% decline month-over-month. This moderation is likely due to a confluence of factors impacting this more affordability-sensitive segment of the market, particularly the impact of higher mortgage rates and the recent boost to inventory levels, tempering competition somewhat.”

LINK to the April 2024 REBGV statistics.

FVREB: MODEST INCREASE IN APRIL HOME SALES IN THE FRASER VALLEY TAKES LEAD FROM COOLER SPRING WEATHER

Supply of available homes in the Fraser Valley market continued to build last month, however buyers remained relatively hesitant, leading to a cooler resale market in April. While sales were the third lowest recorded for an April in the last decade, inventory continues to build, reaching levels not seen since September 2020.

“We are seeing a relatively calm and balanced market right now,” said Jeff Chadha, Chair of the Fraser Valley Real Estate Board. “Which means buyers have time to shop around and purchase a home without the pressure of a few years ago, and while prices are holding fairly steady across all property types.”

“We are seeing a relatively calm and balanced market right now,” said Jeff Chadha, Chair of the Fraser Valley Real Estate Board. “Which means buyers have time to shop around and purchase a home without the pressure of a few years ago, and while prices are holding fairly steady across all property types.”

LINK to the April 2024 FVREB statistics.

VIREB: MORE INVENTORY BENEFITS BOTH BUYERS AND SELLERS

VIREB Chief Executive Officer Jason Yochim says that the spring market, which typically starts showing signs of life in February, is finally here. “Sales are up from March, and realtors are showing a lot of homes,” says Yochim. “Listings have also had a healthy boost, which is positive news, and sellers are responding to changing market conditions with price adjustments.” Yochim adds that Vancouver Island has experienced chronically low inventory for several years, so additional listings benefit buyers and sellers. “More inventory means more choices for buyers, but sellers also need somewhere to go when their home is purchased,” says Yochim. “Additional listings are a win-win for everyone.”

LINK to the April 2024 VIREB statistics.