Throughout 2023, Canadians grappled with economic uncertainty and volatile housing markets, particularly in Metro Vancouver. We believe that 2024 will be the start of a dramatic turnaround in the real estate market.

Inflation: After a significant drop from its peak of 8.1% in July 2022 to 4.0% in September 2023, inflation is expected to return to the Bank of Canada's target range of 1-3% by Q3 2024. The Bank's restrictive monetary policy has slowed retail spending, affected housing markets, and increased unemployment, contributing to disinflationary trends.

Interest Rates: Canada's central bank is anticipated to start reducing interest rates by 200 basis points from the current 5.00% in response to a slowing economy, aiming for a "neutral" interest rate between 2.50-3.00%. This reduction could begin in Q2 2024.

Housing Market: Home sales all over Vancouver Island, and the Lower Mainland declined drastically, influenced by higher borrowing costs. Despite this, pent-up demand is starting to percolate and we have seen much higher activity in Open Houses and property inquiries. So far, that hasn't always resulted in a pending offer but it is heartening for those that need to sell.

Inflation: After a significant drop from its peak of 8.1% in July 2022 to 4.0% in September 2023, inflation is expected to return to the Bank of Canada's target range of 1-3% by Q3 2024. The Bank's restrictive monetary policy has slowed retail spending, affected housing markets, and increased unemployment, contributing to disinflationary trends.

Interest Rates: Canada's central bank is anticipated to start reducing interest rates by 200 basis points from the current 5.00% in response to a slowing economy, aiming for a "neutral" interest rate between 2.50-3.00%. This reduction could begin in Q2 2024.

Housing Market: Home sales all over Vancouver Island, and the Lower Mainland declined drastically, influenced by higher borrowing costs. Despite this, pent-up demand is starting to percolate and we have seen much higher activity in Open Houses and property inquiries. So far, that hasn't always resulted in a pending offer but it is heartening for those that need to sell.

If you are thinking of buying a home, don't wait. Our real estate market has no balance. It's either slow or out of control. It's better to shop when you aren't competing with so many other buyers.

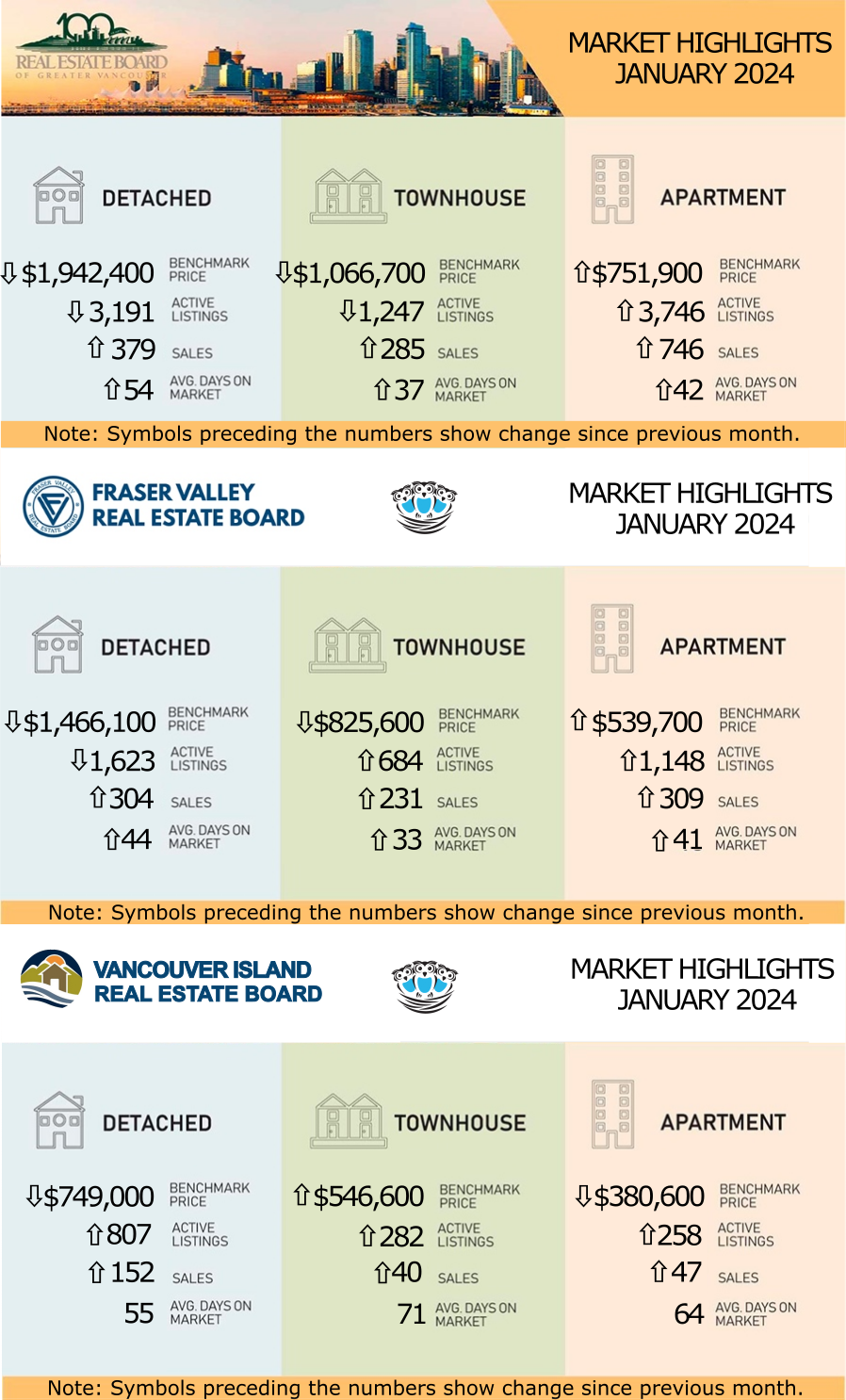

REBGV: HOME SALES ACROSS METRO VANCOUVER'S HOUSING MARKET OFF TO STRONG START IN 2024

While the Metro Vancouver market ended 2023 in balanced market territory, conditions in January began shifting back in favour of sellers as the pace of newly listed properties did not keep up with the jump in home sales.

“It’s hard to believe that January sales figures came in so strong after such a quiet December, which saw many buyers and sellers delaying major decisions,” Andrew Lis, REBGV’s director of economics and data analytics said. “If sellers don’t step off the sidelines soon, the competition among buyers could tilt the market back into sellers’ territory as the available inventory struggles to keep pace with demand.”

“Our 2024 forecast is calling for a two to three percent increase in prices by the end of the year, which is largely the result of demand, once again, butting up against too little inventory,” Lis said. “If the January figures are indicative of what the spring market has in store, our forecast may already be off to an overly conservative start. Markets can shift quickly, however, and we’ll watch the February numbers to see if these early signs of strength continue, or whether they’re a blip in the data.”

“It’s hard to believe that January sales figures came in so strong after such a quiet December, which saw many buyers and sellers delaying major decisions,” Andrew Lis, REBGV’s director of economics and data analytics said. “If sellers don’t step off the sidelines soon, the competition among buyers could tilt the market back into sellers’ territory as the available inventory struggles to keep pace with demand.”

“Our 2024 forecast is calling for a two to three percent increase in prices by the end of the year, which is largely the result of demand, once again, butting up against too little inventory,” Lis said. “If the January figures are indicative of what the spring market has in store, our forecast may already be off to an overly conservative start. Markets can shift quickly, however, and we’ll watch the February numbers to see if these early signs of strength continue, or whether they’re a blip in the data.”

LINK to the January 2024 REBGV statistics.

FVREB: SIGNS OF STABILITY IN FRASER VALLEY HOUSING MARKET

The Fraser Valley real estate market showed signs of recovery in January as home sales rose after six consecutive months of decline, and new listings more than doubled.

“With January sales on the rise, we are seeing hopeful signs that optimism is returning to the market,” said Narinder Bains, Chair of the Fraser Valley Real Estate Board. “Anticipating that we may be at the end of the Bank of Canada rate hike cycle, it appears that more buyers are considering re-entering the market as we are starting to see more traffic at open houses.”

“Current balanced market conditions present opportunities for both buyers and sellers,” said FVREB CEO, Baldev Gill. “In today’s market, buyers and sellers have time to get preapprovals, put together offers and take the time needed to work through the purchase or sale of a home with the help of a knowledgeable and professional REALTOR.”

“With January sales on the rise, we are seeing hopeful signs that optimism is returning to the market,” said Narinder Bains, Chair of the Fraser Valley Real Estate Board. “Anticipating that we may be at the end of the Bank of Canada rate hike cycle, it appears that more buyers are considering re-entering the market as we are starting to see more traffic at open houses.”

“Current balanced market conditions present opportunities for both buyers and sellers,” said FVREB CEO, Baldev Gill. “In today’s market, buyers and sellers have time to get preapprovals, put together offers and take the time needed to work through the purchase or sale of a home with the help of a knowledgeable and professional REALTOR.”

LINK to the January 2024 FVREB statistics.

VIREB: NORMAL JANUARY KICKS OFF 2024 WITH OPTIMISTIC OUTLOOK

“We had a fairly normal January, with unit sales of 354 compared to 340 last year,” says Ian Mackay, 2024 Chair. “REALTORS® are reporting that plenty of listings are hitting the system, and we’re sensing a lot of optimism regarding the spring market.”

However, interest rates and the mortgage stress test (Guideline B-20) continue to deter some buyers, as does the pervasive low inventory in the VIREB area, which limits the selection of affordable homes. Mackay, who works primarily in Parksville-Qualicum, notes that properties listed in a moderate range are selling remarkably quickly.

LINK to the January 2024 VIREB statistics.

STATS CENTRE REPORTS

The Stats Centre Reports for the REBGV for January are available now on our website at this link under the "BLOG AND STATS" heading. They are automatically updated every month on our website as they become available. LINK

Note that you may have to refresh the screen a few times until all the reports come up. This is a problem with the Real Estate Board website.

COMMON REAL ESTATE SCAMS IN CANADA: 2024 EDITION

1) Wire Fraud Scam:

In various wire fraud scenarios, criminals often pose as your real estate agent or seller, convincing you to make a wire payment to a foreign bank account for the supposed purchase of a property.

2) Foreclosure Relief Scam:

This fraudulent scheme involves organizations claiming to help individuals facing foreclosure by offering assistance such as loan modifications. However, these scammers end up taking money without providing any genuine help.

3) Bait-and-Switch Listing Scam:

3) Bait-and-Switch Listing Scam:

Criminals advertise a property at an attractive price, either for sale or rent, only to substitute it with a different property of much lower quality or a significantly higher price.

4) Home Inspection Scam:

4) Home Inspection Scam:

Unqualified individuals posing as certified house inspectors deceive by concealing potential property issues during inspections.

5) Rental Scam:

5) Rental Scam:

Scammers send deceptive emails or online messages, seemingly from a legitimate rental company, requesting deposit money for properties that don't actually exist.

6) Title or Deed Scam:

6) Title or Deed Scam:

A property fraud type where scammers falsely claim ownership of a property and sell it to unsuspecting buyers using fake documents like deeds or titles to create an illusion of legal rights.

If you suspect you've fallen victim to a real estate scam or have concerns about a transaction, promptly report it to the appropriate authorities. To report a real estate scam in Canada, contact the Canadian Anti-Fraud Centre through their website at www.antifraudcentre-centreantifraude.ca.

If you suspect you've fallen victim to a real estate scam or have concerns about a transaction, promptly report it to the appropriate authorities. To report a real estate scam in Canada, contact the Canadian Anti-Fraud Centre through their website at www.antifraudcentre-centreantifraude.ca.