The last month of 2023 did not reveal any surprises in the BC real estate market. As is common for December, sales activity was down and exacerbated further by high interest rates. The high interest rates have kept many buyers (and even sellers) on the sidelines, and with the rates expected to ease up in 2024, we expect a flurry of buyer and seller activity.

BC Assessments for 2024 are out and available online: LINK.

In the interview with CTV News, BC Assessment said on Tuesday that the vast majority of markets in Metro Vancouver, the Lower Mainland, Sunshine Coast, Greater Victoria, and the Okanagan saw the typical 2024 valuation of a single-family home stay within a 5% increase or decrease in price. It is "notably" less volatile than what the Vancouver area has seen in recent years, the Crown corporation said. The assessed value of a single-family home in Vancouver, which reflected the market on July 1, 2023, rose four percent to just above $2.2 million, while strata properties remained nearly unchanged at $807,000. Full article here: LINK

BC Assessments for 2024 are out and available online: LINK.

In the interview with CTV News, BC Assessment said on Tuesday that the vast majority of markets in Metro Vancouver, the Lower Mainland, Sunshine Coast, Greater Victoria, and the Okanagan saw the typical 2024 valuation of a single-family home stay within a 5% increase or decrease in price. It is "notably" less volatile than what the Vancouver area has seen in recent years, the Crown corporation said. The assessed value of a single-family home in Vancouver, which reflected the market on July 1, 2023, rose four percent to just above $2.2 million, while strata properties remained nearly unchanged at $807,000. Full article here: LINK

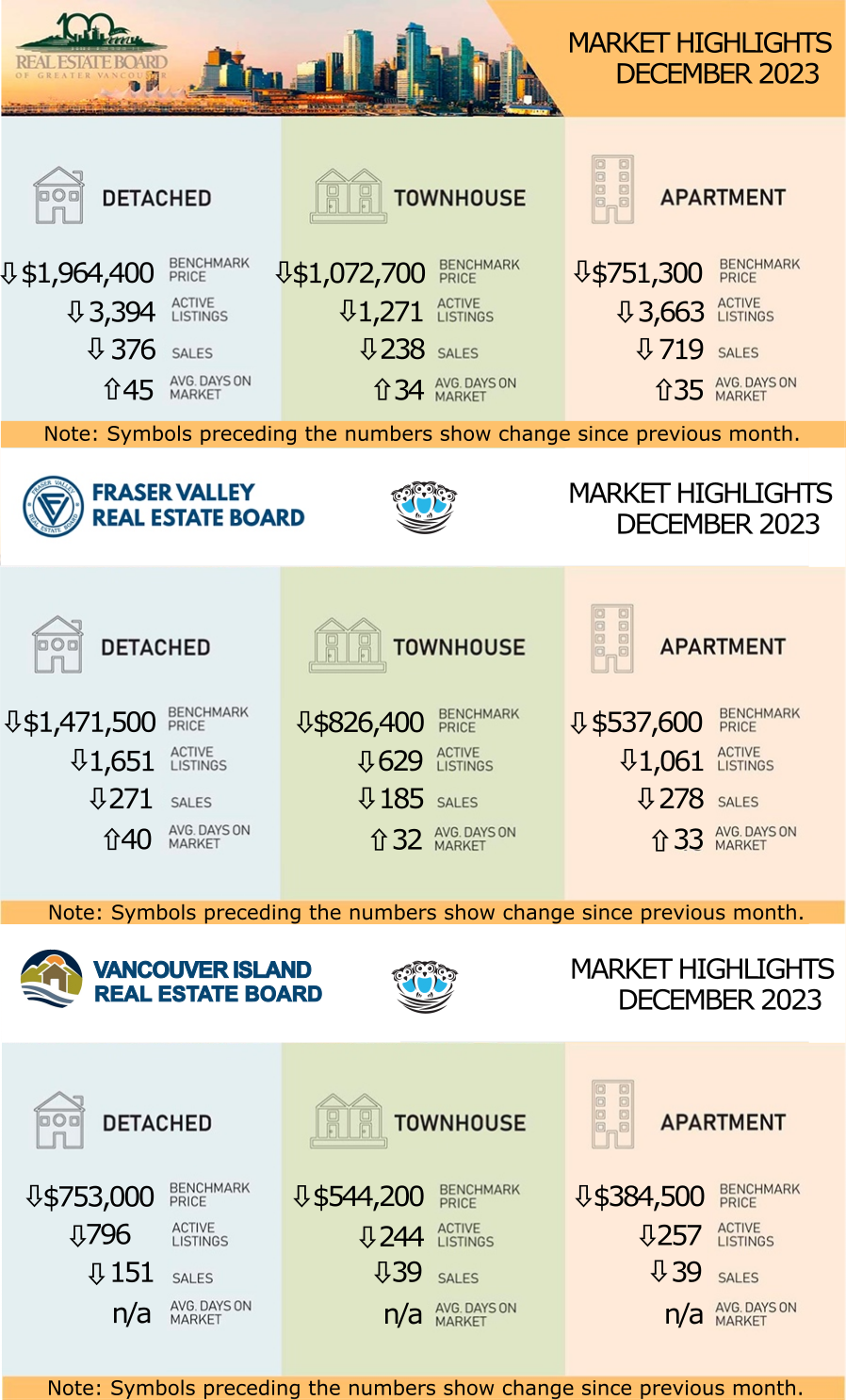

REBGV: METRO VANCOUVER HOUSING MARKET SHOWS RESILIENCE IN 2023, ENDING THE YEAR IN BALANCED TERRITORY

Metro Vancouver’s housing market closed out 2023 with balanced market conditions, but the year-end totals mask a story of surprising resilience in the face of the highest borrowing costs seen in over a decade.

“You could miss it by just looking at the year-end totals, but 2023 was a strong year for the Metro Vancouver housing market considering that mortgage rates were the highest they’ve been in over a decade,” Andrew Lis, REBGV’s director of economics and data analytics said. “In our 2023 forecast, we called for modest price increases throughout the year while most other forecasters were predicting price declines. The fact that we ended the year with 5% plus gains in home prices across all market segments demonstrates that Metro Vancouver

remains an attractive and desirable destination, and elevated borrowing costs alone aren’t enough to dissuade buyers determined to get into this market.”

“Ultimately, the story of 2023 is one of too few homes available relative to the pool of willing and qualified buyers,” Lis said. “Sellers were reluctant to list their properties early in the year, which led to fewer sales than usual coming out of the gate. But this also led to near record-low inventory levels in the spring, which put upward pressure on prices as buyers competed for the scarce few homes available.”

“Looking back on the year, it’s hard not to wonder how we’d be closing out 2023 if mortgage rates had been a few percent lower than they were. And it looks like we might get some insight into that question in 2024, as bond markets and professional forecasters are projecting lower borrowing costs are likely to come, with modest rate cuts expected in the first half of the New Year.”

LINK to the December 2023 REBGV statistics.

“You could miss it by just looking at the year-end totals, but 2023 was a strong year for the Metro Vancouver housing market considering that mortgage rates were the highest they’ve been in over a decade,” Andrew Lis, REBGV’s director of economics and data analytics said. “In our 2023 forecast, we called for modest price increases throughout the year while most other forecasters were predicting price declines. The fact that we ended the year with 5% plus gains in home prices across all market segments demonstrates that Metro Vancouver

remains an attractive and desirable destination, and elevated borrowing costs alone aren’t enough to dissuade buyers determined to get into this market.”

“Ultimately, the story of 2023 is one of too few homes available relative to the pool of willing and qualified buyers,” Lis said. “Sellers were reluctant to list their properties early in the year, which led to fewer sales than usual coming out of the gate. But this also led to near record-low inventory levels in the spring, which put upward pressure on prices as buyers competed for the scarce few homes available.”

“Looking back on the year, it’s hard not to wonder how we’d be closing out 2023 if mortgage rates had been a few percent lower than they were. And it looks like we might get some insight into that question in 2024, as bond markets and professional forecasters are projecting lower borrowing costs are likely to come, with modest rate cuts expected in the first half of the New Year.”

LINK to the December 2023 REBGV statistics.

FVREB: FRASER VALLEY CLOSES OUT 2023 WITH LOWEST ANNUAL SALES RECORDED IN 10 YEARS

High interest rates kept a lid on sales and listings in the Fraser Valley in 2023, while holding year-over-year price growth to low single digits. “Back-to-back mid-year interest rate hikes slowed the market despite strong sales and new listings in the spring,” said Narinder Bains, Chair of the Fraser Valley Real Estate Board. “This left the market in overall balance for the latter half of the year, albeit at low levels of activity. We anticipate 2024 will bring increased optimism on behalf of buyers and sellers as the Bank of Canada is expected to lower interest rates before mid-year.”

“2023 saw buyers and sellers adjust to new rate realities, and the impact of those high rates were reflected in the low number of sales in the Fraser Valley,” said FVREB CEO Baldev Gill. “However, as rates start to ease, we expect market activity will pick up. This will create opportunities for buyers and sellers who are advised to consult with a professional REALTOR® before jumping into the market.”

High interest rates kept a lid on sales and listings in the Fraser Valley in 2023, while holding year-over-year price growth to low single digits. “Back-to-back mid-year interest rate hikes slowed the market despite strong sales and new listings in the spring,” said Narinder Bains, Chair of the Fraser Valley Real Estate Board. “This left the market in overall balance for the latter half of the year, albeit at low levels of activity. We anticipate 2024 will bring increased optimism on behalf of buyers and sellers as the Bank of Canada is expected to lower interest rates before mid-year.”

“2023 saw buyers and sellers adjust to new rate realities, and the impact of those high rates were reflected in the low number of sales in the Fraser Valley,” said FVREB CEO Baldev Gill. “However, as rates start to ease, we expect market activity will pick up. This will create opportunities for buyers and sellers who are advised to consult with a professional REALTOR® before jumping into the market.”

LINK to the December October 2023 FVREB statistics.

VIREB: LACKLUSTRE DECEMBER CLOSES OUT 2023

High interest rates are primarily to blame for the weaker sales, as there was significant demand, but many buyers opted to wait for an anticipated 2024 rate cut.

“Based on conversations REALTORS® are having with clients, there is certainly demand out there, so we’re expecting a fairly busy spring,” says Kelly O’Dwyer, 2023 Chair. “However, there are policy changes coming in 2024 that could impact the real estate market, such as new rules surrounding short-term rentals that take effect on May 1.”

Another potentially significant policy change that could impact sales is the B.C. government’s decision to expand the speculation tax to Parksville, Qualicum Beach, Courtenay, Comox, and Cumberland. Residents in those communities must declare for the first time in January 2025 based on how they use their property in 2024.

VIREB: LACKLUSTRE DECEMBER CLOSES OUT 2023

High interest rates are primarily to blame for the weaker sales, as there was significant demand, but many buyers opted to wait for an anticipated 2024 rate cut.

“Based on conversations REALTORS® are having with clients, there is certainly demand out there, so we’re expecting a fairly busy spring,” says Kelly O’Dwyer, 2023 Chair. “However, there are policy changes coming in 2024 that could impact the real estate market, such as new rules surrounding short-term rentals that take effect on May 1.”

Another potentially significant policy change that could impact sales is the B.C. government’s decision to expand the speculation tax to Parksville, Qualicum Beach, Courtenay, Comox, and Cumberland. Residents in those communities must declare for the first time in January 2025 based on how they use their property in 2024.

LINK to the December 2023 VIREB statistics.