September’s new listings were 1.2 percent below the 10-year average for the month.

“The summer trend of above-average home sales and historically typical new listings activity continued in Metro Vancouver last month. Although this is keeping the overall supply of homes for sale low, we’re not seeing the same upward intensity on home prices today as we did in the spring,” Keith Stewart, REBGV economist said. “Home price trends will, however, vary depending on property type and neighbourhood, so it’s important to take a hyperlocal look at your location and property category of choice before making a home buying or selling decision.”

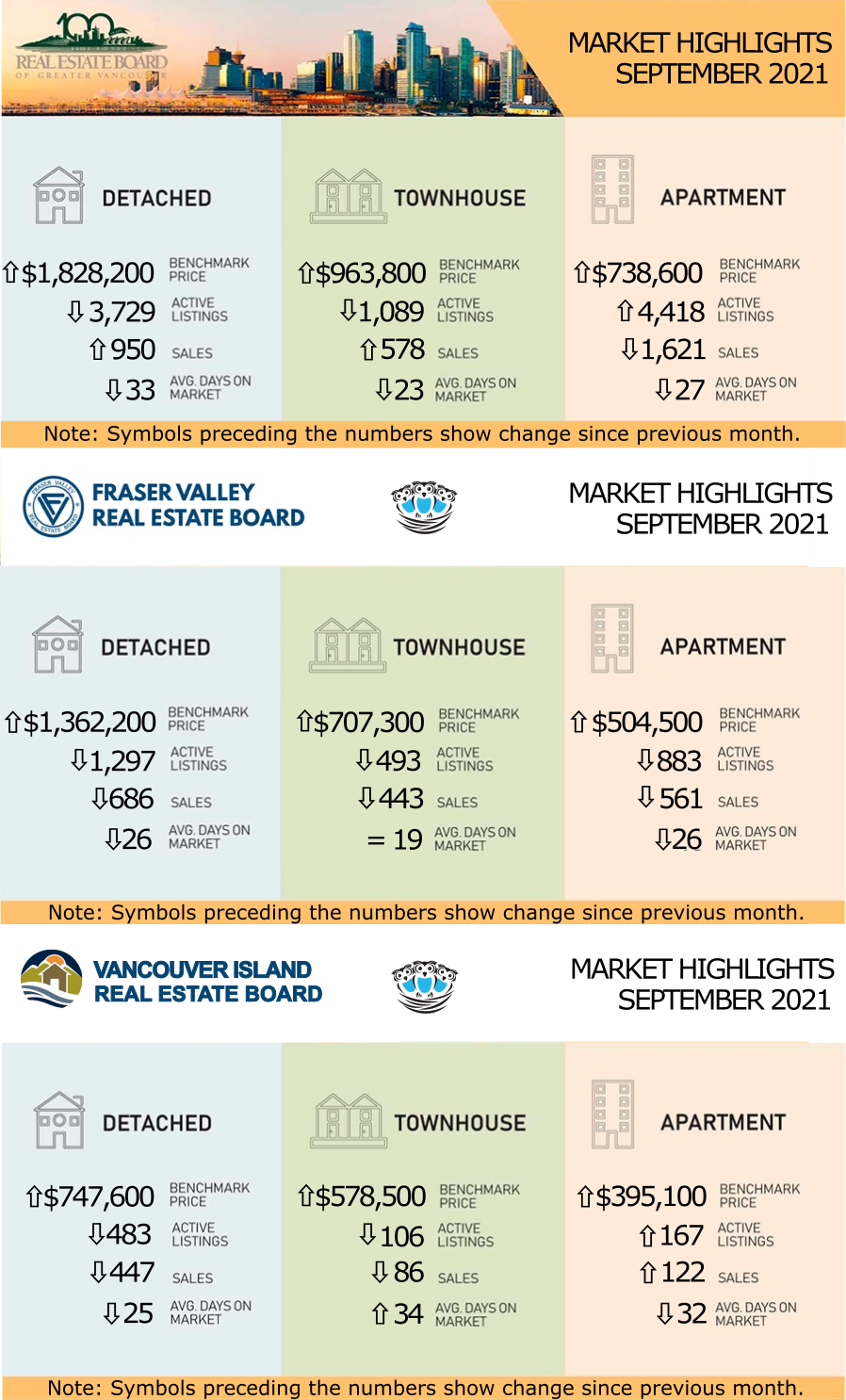

For all property types, the sales-to-active listings ratio for September 2021 is 34.1 percent. By property type, the ratio is 25.5 percent for detached homes, 53.1 percent for townhomes, and 36.7 percent for apartments.

POSITIVE START TO FALL MARKET; NEW LISTINGS INCREASE, SALES SOFTEN

Demand for Fraser Valley real estate remained robust in September. While overall sales decreased

compared to August, total sales reached the second-highest levels for the month of September in the 100-year history of the Board.

Larry Anderson, President of the Board, said, “While we’ve seen a solid increase in new listings compared to August, market conditions continue to be challenging for buyers. Considering the demand across the region, the increase is simply not enough to bolster the inventory required to create a greater balance in the market. Demand for residential homes of all types is strong in the Fraser Valley with more sellers returning to the table in September, which is expected at this time of year.”

The housing market in the Vancouver Island Real Estate Board (VIREB) area finished summer the way it began, with historically low inventory and rising prices.

Active listings of single-family homes were 47 percent lower last month than in September 2020, while VIREB’s inventory of condo apartments and row/townhouses dropped by 57 percent and 48 percent, respectively, from one year ago.

In its most recent housing forecast, the British Columbia Real Estate Association (BCREA) states that the supply situation is especially severe in markets outside the Lower Mainland, including Vancouver Island.

Listings activity has been lacklustre, and even if sales come back down to long-run average levels, total

listings would need to nearly double to bring markets back into balance.

Ian Mackay, 2021 VIREB President, confirms that lack of inventory is hampering sales in the VIREB area, and multiple offers on well-priced, quality properties continue to be the norm.

“There is no doubt that sales would be considerably higher if we had more listings,” says Mackay. “The

demand is there, but the supply isn’t.”

Note that you may have to refresh the screen a few times until all the reports come up. This is a problem with the Real Estate Board website.

Below is a link to a graph showing the rise in prices in the Lower Mainland just for resale properties (no new homes) over the last year. This link is live so it will update when the new statistics come in each month. LINK to live graph

INCOME TAXES AND PROPERTY SALES

Most individuals who sell real estate are aware that a sale of a principal residence does not attract income tax.

The Income Tax Act requires individuals to file a prescribed form with their income tax return for the year in which the principal residence is sold. In practice, however, the vast majority of individuals who sell their principal residence will merely ignore the requirement to file the proper forms under the assumption that the sale is not taxable.

i) Housing unit,

The CRA has adopted a very liberal approach as far as administering what is meant by the term “ordinarily inhabited”. For example, a summer cottage or winter home which is used (by the owner) for a portion of the year (ie a period of two weeks appears to qualify), could meet the definition of “ordinarily inhabited”. Furthermore, properties occupied for a portion of the year because they were purchased late or sold early in the year will also qualify.

The principal residence can include land upon which a housing unit is situated if the land contributes to the “use and enjoyment of the housing unit as a residence”. However, if the land exceeds one and one-quarter acres, in order for the excess to qualify, the onus is on the individual to prove that the excess was necessary for the “use and enjoyment as a principal residence”.

The article was provided by, Spagnuolo & Company LLP

www.bcrealestatelawyers.com