Firstly, I want to apologize that this email is so late. The person at the Board that produces the pretty statistic reports for the different areas in the REBGV must have been on vacation. :^) We usually get access to them at the end of the first week of the month but this month they were delayed for another week. You will find links to those reports in the table below.

We're now over half-way through the month of June and we are seeing some signs of life in the market.- There have been some multiple offers on some well-priced and well-presented homes.

- The majority of buyers appear to still be waiting on the sidelines.

- Interest rates have dropped further. The best rate in the market is 2.59% for a 5 year fixed mortgage.

- There is political pressure from the (potentially incoming) Conservative government to repeal or modify the B20 Stress Test mortgage guidelines. If the Liberal government adjusts the guidelines to the benefit of buyers, we could see a spike in sales as the pent-up demand is released

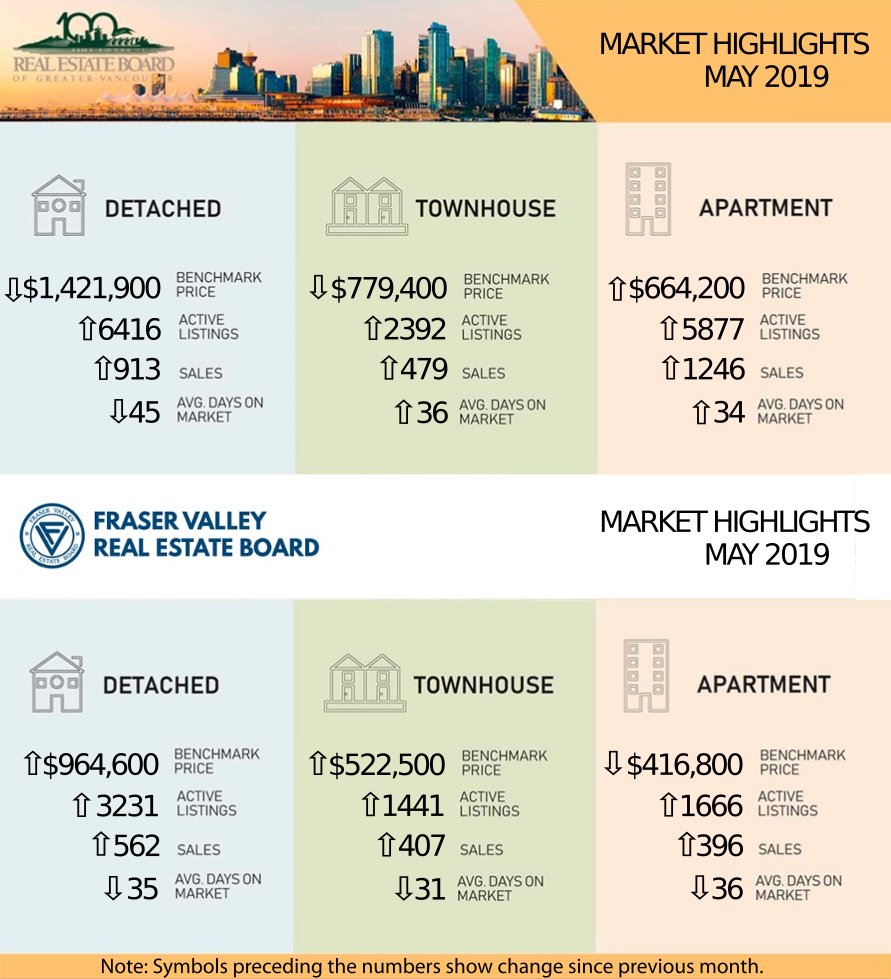

From the REBGV May Statistics:

Click on the links (in blue) below for the statistics package for your area: (The links each take a few second to open as they are files stored on my Google Drive.) |

| BURNABY/NEW WEST | |||

| Burnaby East | Burnaby North | Burnaby South | New Westminster |

| TRI-CITIES | |||

| Coquitlam | Port Coquitlam | Port Moody | |

| VANCOUVER | |||

| Metro Vancouver | Vancouver East | ||

| NORTH SHORE | |||

| North Vancouver | West Vancouver | ||

| SOUTH FRASER/RICHMOND | |||

| Ladner | Tsawwassen | Richmond | |

| RIDGE MEADOWS | |||

| Pitt Meadows | Maple Ridge | ||

| UP THE COAST/ISLAND | |||

| Bowen Island | Squamish | Sunshine Coast | Whistler |

Here are the full statistic packages for Greater Vancouver and the Fraser Valley (which includes Surrey, North Surrey, South Surrey/White Rock, Cloverdale, Delta, Langley, Abbotsford, Chilliwack, and Mission.) Below is a link to a graph showing the rise in prices in the Lower Mainland just for resale properties (no new homes) over the last year. This link is live so it will update when the new statistics come in each month. LINK to live graph ______________________________________________________ Avoid the Following Financial Sins When Applying For a Mortgage Planning to buy a home soon? Make sure that you are aware of all the factors that can affect your ability to qualify for a mortgage approval. To allow for a higher probability for an approval and the best terms, follow these 10 home buying commandments. 1) Thou shalt not change jobs, become self-employed, or quit your job. 2) Thou shalt not buy a car, truck, or van, boat, RV. etc. 3) Thou shalt not use credit cards excessively. 4) Thou shalt not let current accounts fall behind. 5) Thou shalt not spend money you have set aside for down payment and closing costs. 6) Thou shalt not finance any new furniture. 7) Thou shalt not originate any inquires into your credit. 8) Thou shalt not make cash deposits without checking with your loan officer. 9) Thou shalt not change bank accounts. 10) Thou shalt not co-sign a loan for anyone.

Please feel free to contact us if you would like specific information for your neighborhood, would like to be set up on a search to keep track of your local market, or if you would like a market evaluation of the value of your home.

|