The month of March brought additional much-needed inventory to our real estate markets but many buyers are still waiting for interest rate cuts.

These interest rate cuts depend on the latest economic data The latest employment data comes days before the Bank of Canada’s next interest rate announcement, which is set for April 10. The central bank has been looking for signs that the labour market is cooling, and by extension taking some steam out of inflation, as it debates how long to keep interest rates elevated. BMO chief economist Doug Porter said on Wednesday that while the rising unemployment rate suggests a slackening in the labour market, still-hot wage growth puts the Bank of Canada in a “tricky spot.” Porter also said that a June rate cut is “looking a bit more likely now.” He said that the Bank of Canada could sound more “dovish” – opening the door to rate cuts in the future – at its April 10 decision. Here is a link to the full Global News ARTICLE.

These interest rate cuts depend on the latest economic data The latest employment data comes days before the Bank of Canada’s next interest rate announcement, which is set for April 10. The central bank has been looking for signs that the labour market is cooling, and by extension taking some steam out of inflation, as it debates how long to keep interest rates elevated. BMO chief economist Doug Porter said on Wednesday that while the rising unemployment rate suggests a slackening in the labour market, still-hot wage growth puts the Bank of Canada in a “tricky spot.” Porter also said that a June rate cut is “looking a bit more likely now.” He said that the Bank of Canada could sound more “dovish” – opening the door to rate cuts in the future – at its April 10 decision. Here is a link to the full Global News ARTICLE.

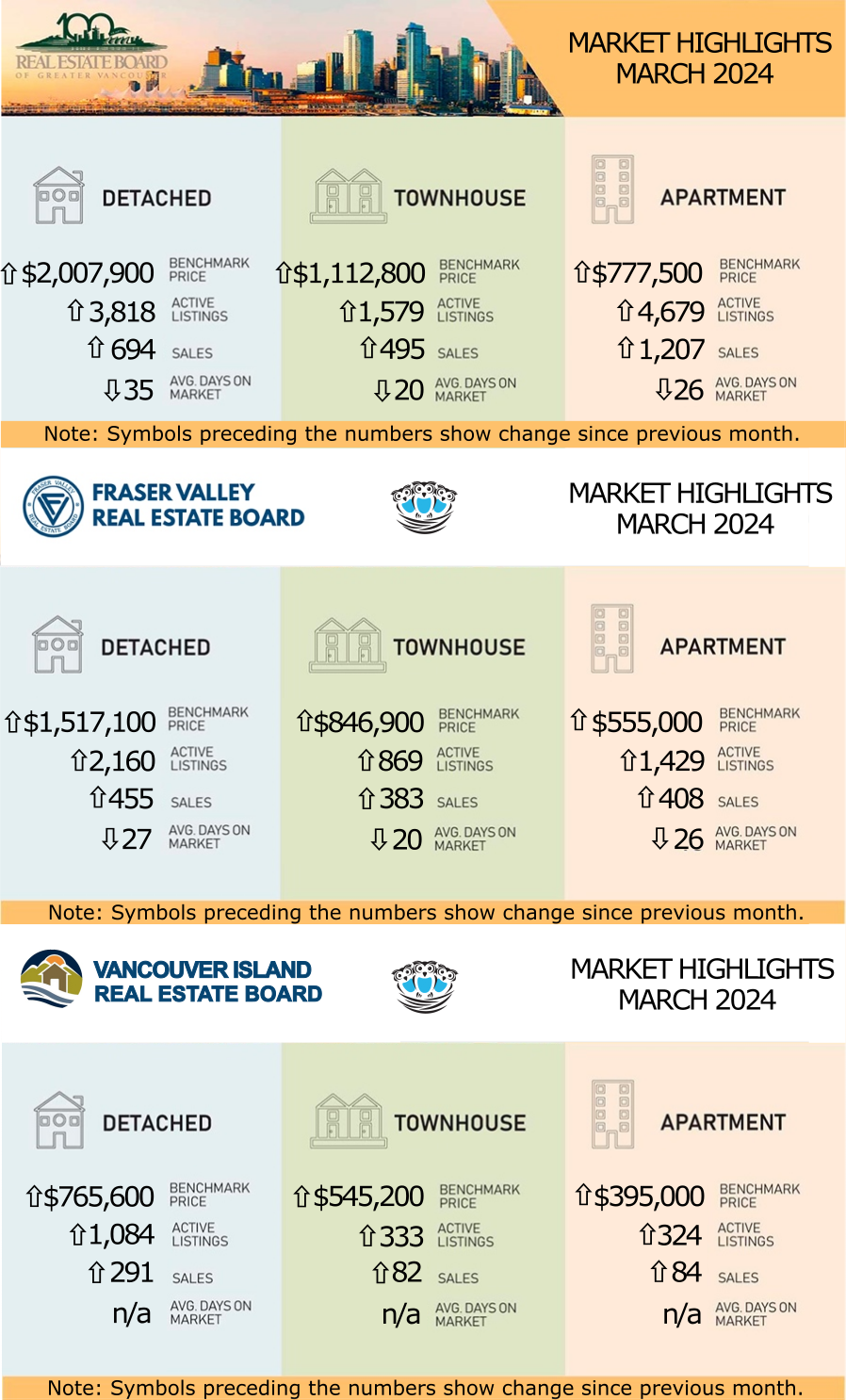

REBGV: INCREASED SELLER ACTIVITY IS GIVING BUYERS MORE CHOICE THIS SPRING

“If you’re finding the weather a little chillier than last spring, you may find some comfort in knowing that the market isn’t quite as hot as it was last spring either, particularly if you’re a buyer,” Andrew Lis, GVR’s director of economics and data analytics said. “Despite the welcome increase in inventory, the overall market balance continues inching deeper into sellers’ market territory, which suggests demand remains strong for well-priced and well-located properties.”

“Even though the market isn’t quite as hot as it was last year, we’re still seeing modest month-over-month price gains of one to two percent happening at the aggregate level, which is an interesting dynamic given that borrowing costs remain elevated,” Lis said. “With the latest inflation numbers trending in the right direction, it remains likely that we’ll see at least one or

two modest cuts to the Bank of Canada’s policy rate in 2024, but even if these cuts come, they may not provide the boost to affordability many had been hoping for. As a result, we expect constrained borrowing power to remain a challenging headwind as we move into the summer months.”

LINK to the March 2024 REBGV statistics.

FVREB: MARCH HOME SALES GROWTH OFF LAST MONTH'S PACE, BUT SUPPLY STILL BUILDING IN THE FRASER VALLEY

Home buyers in the Fraser Valley have more choice heading into the spring market with inventory levels for March at the highest they’ve been in the past five years. However, March sales were slower than anticipated with 1,395 transactions recorded. Sales were the second lowest recorded for a March in a decade.

“With inventory building, buyers now have more opportunities in both the detached and attached markets compared to one year ago,” said Jeff Chadha, Chair of the Fraser Valley Real Estate Board. “However, despite increased options, some buyers may still be waiting on the sidelines for the financing landscape to further settle before they feel comfortable getting back into the market.”

LINK to the March 2024 FVREB statistics.

VIREB: MARCH HOUSING MARKET CALMER THAN EXPECTED

“As we reported last month, there is a lot of interest among potential buyers,” says Jason Yochim, VIREB Chief Executive Officer. “REALTORS® are definitely busy, although the statistics don’t reflect that. We expect it will be June before the numbers catch up with pent-up demand.” Yochim adds that a contingent of buyers is waiting to see what the Bank of Canada will do with interest rates.

“The VIREB area is geographically widespread, so market conditions in Nanaimo won’t be the same as in Port Alberni,” adds Yochim. “However, properties priced appropriately for their location attract the most interest and sell more quickly than overpriced homes. That’s why the knowledge a local REALTOR® brings to the table is invaluable.”

LINK to the March 2024 VIREB statistics.