There is nothing surprising to report for the February month market activity... more properties were newly listed and the sales activity increased month over month. Bank of Canada had their meeting yesterday and decided to hold its key interest rate steady at 5% again. What was unexpected was some noteworthy changes from the new BC Budget.

PROPERTY TRANSFER TAX

Starting April 1st, 2024, new Property Transfer Tax (PTT) changes are taking effect. The increased thresholds and exemptions for Property Transfer Tax will benefit first-time homebuyers and new home purchasers.

PROPERTY TRANSFER TAX

Starting April 1st, 2024, new Property Transfer Tax (PTT) changes are taking effect. The increased thresholds and exemptions for Property Transfer Tax will benefit first-time homebuyers and new home purchasers.

- The first-time homebuyer's exception threshold is increased from $500,000 to $835,000, with the first $500,000 exempt from property transfer tax. The phase out range is $25,000 above the threshold, with the complete elimination of the exemption at $860,000.

- The newly built home exemption now eliminates the PTT for eligible first-time home buyers on new homes up to $1,100,000 from the previous $750,000. The phase out range is $50,000 above the threshold, with the complete elimination of the exemption at $1,150,000 for qualifying newly built homes.

- The New purpose-built rental buildings exemption will be in effect starting January 1, 2025 and ending December 31, 2030. This exemption builds on the further two percent property transfer tax exemption for new purpose-built rentals announced in Budget 2023 and the rental housing revitalization tax exemption provided in Budget 2018.

"FLIPPING TAX"

The government is bringing in a new flipping tax, (really, an "anti-flipping tax"), effective January 1, 2025, on the profit made from selling a residential property, including a presale assignment, within two years of buying it. The rate is 20% within the first year of purchase, declining to 0% between 366 and 730 days. The tax will not apply to land or portions of land used for non-residential purposes.

The government is bringing in a new flipping tax, (really, an "anti-flipping tax"), effective January 1, 2025, on the profit made from selling a residential property, including a presale assignment, within two years of buying it. The rate is 20% within the first year of purchase, declining to 0% between 366 and 730 days. The tax will not apply to land or portions of land used for non-residential purposes.

There are exemptions for...

- those adding to the supply of housing or engaging in real estate development and construction

- life circumstances including separation or divorce, death, disability or illness, relocation for work, involuntary job loss, a change in household membership, personal safety, or insolvency.

- In addition to these exemptions, individuals selling their primary residence within two years of purchase can exclude a maximum of $20,000 when calculating their taxable income.

ZONING AND PERMITTING

Allowing small-scale, multi-unit affordable housing including townhomes, duplexes, and triplexes through zoning changes and proactive partnerships.

ELECTRICITY TAX CREDIT

A new, one year electricity affordability credit for all households, regardless of income starting in April 2024. Households will save on average $100 a year on their electricity bills.

Needless to say, we are very excited for all our new home-owners-to-be clients who will be able to benefit from the much-needed and long-overdue increases to PTT exception limits. Feel free to give us a call for more information.

We are also including official links for more information on the above budget changes: Stronger BC - Housing and BC Budget News Releases

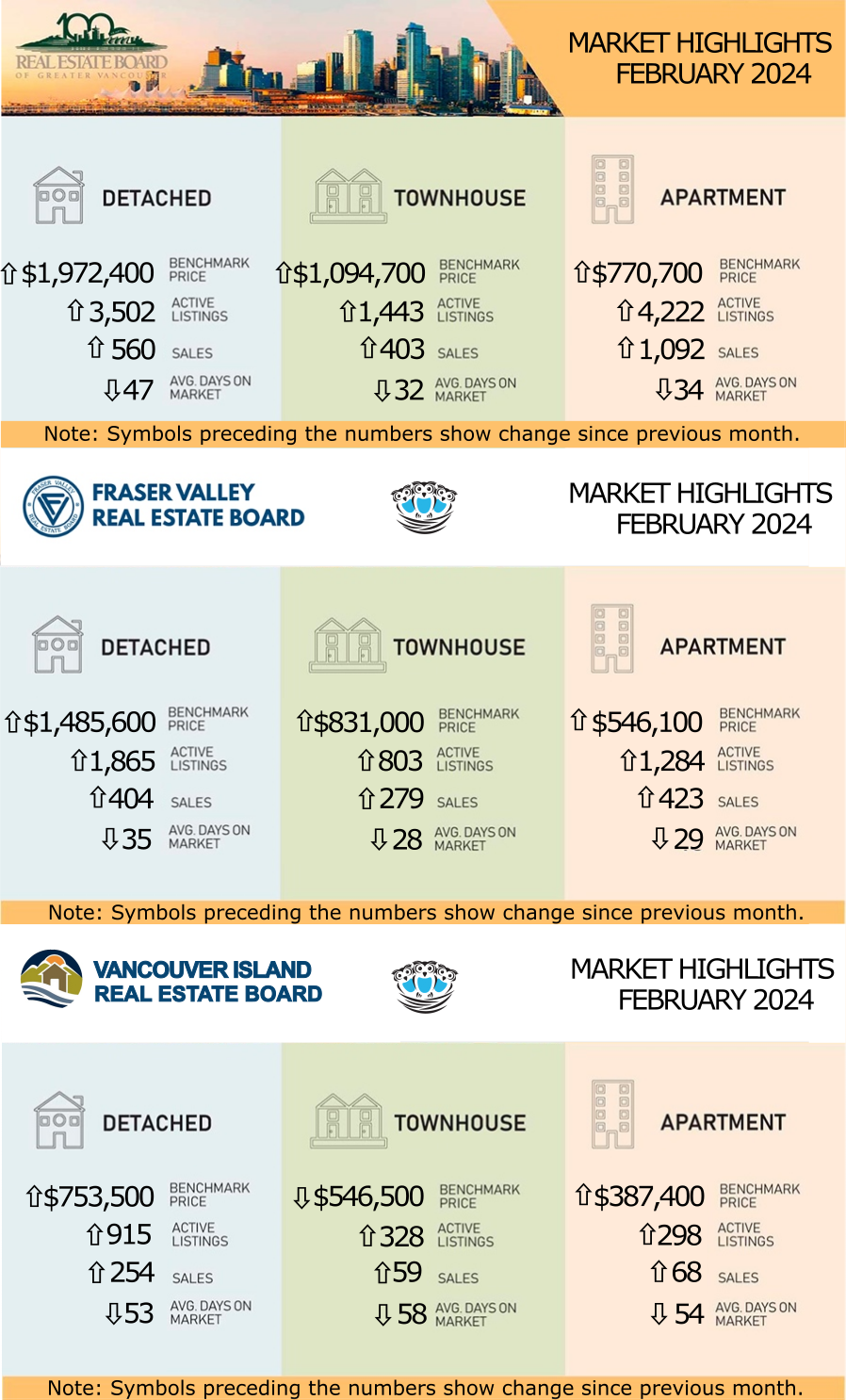

REBGV: HOME SELLERS AWAKEN THIS SPRING, BRINGING MUCH-NEEDED INVENTORY TO THE HOUSING MARKET

“While the pace of home sales started the year off briskly, the pace of newly listed properties in January was slower by comparison. A continuation of this pattern in February would have been concerning, as it could quickly tilt the market towards overheated conditions,” Andrew Lis, GVR’s director of economics and data analytics said. “With new listings up about 31% year-over-year in February, this will relieve some of the pressure that was building in January and offer buyers more choice as we enter the spring and summer markets.”

“Even with the increase in new listings however, standing inventory levels were not high enough relative to the pace of sales to mitigate price acceleration in February, with most segments of the market moving into sellers’ territory,” Lis said. “This competitive dynamic has led to modest price growth across all market segments this month, but it’s noteworthy that

benchmark prices remain below the peak observed in the spring of 2022, before the market internalized the full effect of the Bank of Canada’s tightening cycle.”

“Even with the increase in new listings however, standing inventory levels were not high enough relative to the pace of sales to mitigate price acceleration in February, with most segments of the market moving into sellers’ territory,” Lis said. “This competitive dynamic has led to modest price growth across all market segments this month, but it’s noteworthy that

benchmark prices remain below the peak observed in the spring of 2022, before the market internalized the full effect of the Bank of Canada’s tightening cycle.”

LINK to the February 2024 REBGV statistics.

FVREB: SALES, LISTINGS CONTINUE TO PICK UP HEADING INTO THE SPRING

Home sales in the Fraser Valley posted a second consecutive bump in February as new listings continue to rise and trend slightly above the 10-year seasonal average. “There is somewhat of a buzz in the market right now,” said Narinder Bains, Chair of the Fraser Valley Real Estate Board. “We are seeing new listings come onto the market and realtors continue to see more traffic at open houses, however buyers are still exercising caution. We aren’t out of the woods just yet, but the signs are pointing to a further increase in activity as we head into spring.”

“All indications suggest we will see the Bank of Canada’s overnight rate begin to decrease mid-year, which is encouraging for buyers and sellers,” said FVREB CEO Baldev Gill.

“All indications suggest we will see the Bank of Canada’s overnight rate begin to decrease mid-year, which is encouraging for buyers and sellers,” said FVREB CEO Baldev Gill.

LINK to the February 2024 FVREB statistics.

VIREB: FEBRUARY SEES SIGNIFICANT SALES INCREASE

“Board-wide, sales rose significantly from last February, while month over month, increases were in the high double digits,” says Jason Yochim, VIREB Chief Executive Officer. “REALTORS® are reporting that although many buyers are waiting for spring, pent-up demand is high.”

While much media attention has been on interest rates and a hoped-for reduction from the Bank of Canada, some financial institutions are offering excellent rates. “In fact, five-year fixed rates are between five and seven percent, and for current clients, some banks are offering rates of less than five percent for longer terms,” adds Yochim. “We encourage people to speak to a mortgage professional to determine their best option.”

LINK to the February 2024 VIREB statistics.